February 11, 1911 - February 11, 2011. First Red Devil biplane was flown in Manila with James C. Mars as its first pilot.

Pages

▼

Security Equipments at major PH Airports for Bid

April 28, 2012

|

| Final Security Check Point (FSCP) at NAIA's Terminal 2 showing Xray machine and the walk-through metal detectors |

The Department of Transport and Communication (DOTC) announced Thursday the bulk bidding for the 500-million airport x-ray screening and security equipment

contract next month.

“These

x-rays will be installed in places where there are no screening or where

even if there is equipment, but because of the volume of passengers,

they need additional equipment,”

said Transportation Secretary Manuel Roxas.

Roxas aims to improve airport security at selected aerodomes across the country with commercial flights by installing,

upgrading and layering of security screening of passengers.

“We will make them all to have

two layers of screening just like what we have in NAIA ” says Roxas.

DOTC disclosed that there are 45 airports in the Philippines with scheduled commercial flights with 21 having adequate airport screening. The government intends to procure screening equipment to be installed in 31

airports.

Items

for procurement include 21 sets of initial security checkpoint (ISCP)

screening equipment and 25 sets of final security checkpoint (FSCP)

screening equipment.

The

airports to be installed with the 21 ISCPs are Puerto Princesa, Kalibo,

Tagbilaran, Davao, Laoag, Iloilo, Tacloban, Cotabato, Dipolog, Cagayan

de Oro, Marinduque, Busuanga, Masbate, Calbayog, Catarman, Jolo, Basco,

Sanga-sanga, Siargao, Cauayan and Ozamis.

The

25 FSCPs are Puerto Princesa, Kalibo, Tagbilaran, Davao, two in Laoag,

General Santos, Zamboanga, San Jose, Roxas, Tacloban, Pagadian, Dipolog,

Cagayan de Oro, Marinduque, Busuanga, Masbate, Calbayog, Catarman,

Jolo, Basco, Sanga-sanga, Siargao, Cauayan and Ozamiz.

The procurement also includes nine units of x-ray inspection systems for cargo screening to be installed in Puerto Princesa, Kalibo, General

Santos, Zamboanga, Iloilo, Roxas, Cotabato, Cagayan de Oro and Clark.

Transport Department will also buy 46 units of walk-through metal detectors, 92 units

of hand-held metal detectors, 59 sets of CCTV (closed-circuit

television) IP (Internet protocol) surveillance system, 55 units of UPS

system, 55 sets of AVR system and 55 sets of ergonomic chair for the

x-ray operator.

The airport security project is set for completion before the end of the year.

PAL Drops Airbus for Boeing widebodies

As San Miguel Takes Over PR

April 27, 2012

The 747-800 may be Philippine Airlines flagship plane as the carrier intends to do more business with aircraft manufacturer Boeing Co. this time around according to Ramon Ang, President of San Miguel Corporation.

The airline is now looking more at Boeing's 747-800 program than the A380 of competing manufacturer Airbus.

Ang, a pilot himself, said the A380 cannot fit in the Philippines domestic airport, pointing the airports of Cebu and Davao as very inadequate to support the aircraft type because of its size. Meanwhile, the Boeing Aircraft (747-800) can fit at other domestic airports the airline intends to fly like Puerto Princesa, Cebu, Davao and General Santos.

Ang said there are only two airports capable of handling the A380 in the Philippines, Manila and Clark. While the Boeing 747-800 can be flown to five different domestic points. He further pointed out that the A380 is also too big for the Philippines saying that there is no market for the 600 plus capacity aircraft. The A380 seats 644 in two class configuration while the B748 seat 550 in the same class.

Philippine Airlines operates full service bi-class model, and continues to operate doing so under new management.

The carrier is now finalizing plans to order new wide body fleets, consisting of 12 Boeing 787's and and possibly 4 Boeing 747's to replace its ageing fleet which consists of 5 B747s, 4 A340s. and 8 A330's.

It has 4 Boeing 777-300ER on orders with 2 for delivery this year, and another 2 for delivery next year. It also plans to get 4 more of the same aircraft type so that by 2020 they may have a fleet of 4 B748, 10 777-300ER, and 12 B787.

The first set of B787 is scheduled to be introduced to the airline in 2016 from aircraft lessors and will replace the A330 which will go to low cost subsidiary Air Philippines.

Meanwhile, the remaining narrow bodies will still be held by Airbus A320s accounting to 75% of PAL fleets, inclusive of Air Philippine Express orders.

|

| Philippine Airlines new boss, Ramon Ang |

The carrier’s two main owners Ramon Ang and Lucio Tan, will provide $1 billion capital build up to help fund the fleet expansion program that would buy the airline 80 new aircraft.

Ang however cautioned that the long-haul expansion plans depend upon the Philippines improving safety standards soon as they will fly immediately to New York via Vancouver, Seattle, San Diego and Chicago when the category rating of the country is upgraded to Category 1. It already flies to San Francisco, Los Angeles, Las Vegas and Vancouver in North America, as well as Honolulu and Guam.

Ang however cautioned that the long-haul expansion plans depend upon the Philippines improving safety standards soon as they will fly immediately to New York via Vancouver, Seattle, San Diego and Chicago when the category rating of the country is upgraded to Category 1. It already flies to San Francisco, Los Angeles, Las Vegas and Vancouver in North America, as well as Honolulu and Guam.

Next on the airline's agenda is the return flight to Europe which will commence sometime in 2016 with the arrival of long ranged twins, referring to Boeing's newest baby, the 787 listing London, Paris, Rome, Barcelona, and Frankfurt as destination.

The country is currently blacklisted by the European Union and has a Category 2 rating from the U.S. Federal Aviation Administration for failure of the country's aviation body to meet international safety regulations.

Third on the Agenda is the resumption of flights to the middle east, to be served by its low cost carrier Airphil Express to fly the 2.5 million overseas Filipinos working there who regularly travel back to the Philippines. Airphil Express will be utilizing the A330 to be dispose by PAL upon the arrival of B787s.

As part of the airline's route rationalization, PAL will stop flying to domestic airports where there is not much premium traffic and some regional flights to Air Philippines, while focusing on long- haul, full-service trips. PAL already axed Ozamiz this year with additional destinations to follow soon.

San Miguel Corporation (SMC) is Southeast Asia's largest publicly listed food, beverage and packaging company with $11 billion (US) in gross revenue. It earned $481 million (US) in 2011 from $460 million in 2010.

ACA Hired for NAIA Congestion

April 26, 2012

By Recto Mercene

THE Manila

International Airport Authority (Miaa), the Civil Aviation Authority of

the Philippines (Caap), and the Civil Aeronautics Board (CAB) had hired a

Sydney-based private entity to handle the time slotting of domestic and

international foreign airlines in a bid to address aircraft congestion

at the country’s premier airport.

Airline companies have agreed to foot the bill to pay Airport Coordination Australia (ACA), which has been handling airlines schedules since March, to the tune of between P3 million to P5 million a year.

These three

government agencies submit all airline schedules and any related

parameters via electronic mail to the ACA, which in turn, processes the

information. The new schedule is sent back to the Philippines within 24

hours, according to Miaa General Manager Jose Angel Honrado.

Alvin

Candelaria, officer in charge of the Airport Operations, said the

critical time slotting should be given to a private entity, following

suggestions by the International Air Transport Association (Iata), due

to excessive delays experienced by commercial aviation.

During

a meeting of all aviation stakeholders that includes the Iata, Airline

Operators Council (AOC), Miaa, Caap, CAB, Cebu Pacific, among others, it

was found out that Philippine Airlines (PAL) used to decide time

slotting at the Ninoy Aquino International Airprt (Naia) when it used to

be the sole international and domestic carrier.

However,

with the entry of Cebu Pacific, Zest Air, Airphil Express and Seair,

the slotting was taken out of PAL’s hands to avoid accusations of bias

in choosing the ideal time of departures and arrivals at the Naia.

Still,

numerous delays especially for departures were experienced by the air

carriers, which sometimes had to wait for 45 minutes, wasting aviation

fuel before take-off clearance is given.

It

is not uncommon that a commercial jet, after waiting for more than an

hour at the end of the runway to be given clearance for take-off, had to

go back to the Naia terminal to load fuel again, according to the AOC.

At

the height of air traffic congestion, the Naia was recorded to have

handled 56 aircraft within one hour. The ideal number for “runway

occupancy,” which includes all take-off and landing, is 40 aircraft per

hour.

Candelaria

said that with the entry of ACA, runway occupancy could be reduced to 40

aircrafts per hour. However, some airline operators said this has yet

to be realized, noting that excessive delays are still experienced by

commercial jetliners and noted that the present system could only handle

about 22 to 27 aircrafts per hour.

This

is because the Naia has only one international runway, and another

domestic runway. The two runways are not parallel but were designed to

intersect one another, so that simultaneous operations could not be

carried out.

“We

are still in transition, many factors have yet to be forwarded to ACA to

be stored in their software and data banks before the Naia is able to

attain the ideal time slotting,” he said.

Unlike

parallel runways, where one is solely assigned for take-offs and the

other exclusively for landings, the single runway of the Naia bundles

all runway occupancy within a narrow window.

These are what could be the

peak departure hours of between 6 and 8 a.m., 11 a.m. and 2 p.m., and

10 p.m. and 12 midnight.

These

peak times are chosen by all airline operators because it coincides

with their ideal arrival time at their destinations or at the point of

departure.

Most

domestic carriers wanted to be able to leave the Naia at 2 p.m. because

it allows them to return to Manila before sunset because some provincial

airports are not equipped for nighttime operations.

Higher flight altitude for PAL this time

GOTCHA

By Jarius Bondoc

April 25, 2012

From food and drinks, giant San Miguel Corp. has branched out to heavy industries. Since 2007 the conglomerate plunked $5 billion into oil, power, mining, airports, toll roads, and telecoms. Its 24 acquisitions and mergers, notably in Meralco and of Petron, have all been profitable.

From food and drinks, giant San Miguel Corp. has branched out to heavy industries. Since 2007 the conglomerate plunked $5 billion into oil, power, mining, airports, toll roads, and telecoms. Its 24 acquisitions and mergers, notably in Meralco and of Petron, have all been profitable.The latest is arguably the toughest: SMC’s 49-percent buy into tottering Philippine Airlines. Globally airline commerce is being choked by a dizzying cocktail of US-European financial crises, Arab political tumult, high fuel rates, currency shakiness, and drop in demand for expensive seats. A recent Economist report has it that the US airline industry, the world’s most advanced, is the least lucrative. Giant carriers have taken off with bang, dropped in operating altitude, and saved from crash only by cutbacks and takeovers. Historically since its start, the US sector has lost more than $33 billion.

PAL’s deficits have also been in the multibillions — P1.5 billion in the last quarter of 2011 alone. But bad news doesn’t daunt, only excite, SMC president Ramon S. Ang. Taking over yesterday as PAL president-COO, Ang gives a cockpit’s view of the direction to which he will pilot the company.

First, on PAL’s and most other airlines’ biggest headaches:

• Fuel costs: “Do you think anyone can be better than us in plotting the rise and fall of oil prices and supplies?” When Ang engineered SMC’s 2008 buyout of Petron, the country’s top oil refiner-distributor was $350 million in the red; he has since turned it around. Weeks ago he oversaw SMC’s purchase of 65 percent of Exxon-Mobil of Malaysia. Information (on fuel price spikes and wastage) is power, but more so is corporate synergy, which he foresees among Petron, Exxon-Mobil, and PAL.

• Labor unrest: PAL’s ground crew union, emasculated by the spinoff of certain departments, has announced plans to dialogue with the new boss from SMC. Flight attendants, downcast due to a Supreme Court flip-flop against them, have promised to cooperate. Ang aims to spur them from low morale to high productivity — for their own pay and retirement benefit. Once a pilot rated for several aircraft types, Ang also knows the thinking of PAL plight crews.

• New routes: Flights to more US cities and re-openings in Europe will depend a lot on the Civil Aviation Authority of the Philippines. The state agency needs to get the Philippines’ safety rating upgraded to Category-1 by the US Federal Aviation Administration. To follow suit would be the European Union counterpart, and then the rest of the International Civil Aviation Organization. PAL is largely out of the picture, as the government acquires new flight navigation and airport safety equipment. Still the airline is not taking any chances. Lucio Tan, PAL’s old (and remaining 51-percent owner), had thrown in $2 million to computerize the CAAP, and lent his staff as check pilots. Ang will continue to pitch in: “I trust the government to do its job.”

At the core of Ang’s takeoff plan is PAL’s re-fleeting with 80 (!) new aircraft. Scratch off the 600 to 700-seater super jumbos, only the 400 to 450-seater wide-bodies better suited for Philippine airports. Short-haul flights will be single class: economy; long hauls, two or three classes. Whichever, Ang promises full in-flight services.

How will PAL finance the 80-aircraft purchase? SMC already has plunked in $500 million for PAL’s 49-percent stake, with management control and budget carrier-sister Air Philippines thrown in. SMC is to infuse $250 million more within two months, to be matched by Tan with another $250 million. “You will see our new jumbos within a year,” Ang says of the first rollout from the total $1 billion.

Fares are largely dictated by competition and fuel costs. Asian airlines have been experiencing a drop in purchases of premium seats and cargo space. Ang sees the solution simply in improving ground and in-flight personnel and services. Like most passengers, he hates long queues to buy or refund tickets, and to check in for flights. His solution: enlist the help of SMC subsidiaries. “Plane tickets can be bought from any of Petron’s 3,000 filling stations or Bank of Commerce branches,” Ang says. “That will bring down fares by six percent. You can also pay the terminal fees there.” PAL finally would also have on-line check-in. The new setup would allow passengers to go to the airport only an hour before flight.

Ang also knows the sad state of most airports (SMC is building a state-of-the-art international airfield for Boracay). For convenience, he is contemplating giving complimentary bottled water, courtesy of Magnolia, for passengers in airports that cruelly do not have drinking fountains. Perhaps, even corned beef, meat loaf or chicken nuggets in pandesal, courtesy of SMC Purefoods. Being finicky as well about toilets and in-flight entertainment, expect improvements in those areas as well.

All this, Ang aims to accomplish by bringing with him only a few SMC advisers to help in PAL. “I need monitors of purchases and finance.” The airline’s current $1-billion debts versus EBITDA (earnings before interest, taxes, depreciation and amortization) comply with industry norms. Ang targets within a year PAL’s best revenues in the past, and to be at par with the likes of Cathay Pacific and Singapore Airlines by 2017. To stockholders he promises not just a turnaround, but “a growth story.”

Looking this writer straight in the eye, he asks: “If you were our shareholder, wouldn’t you believe we can do it?”

2P flight to Tawi-Tawi aborted due to engine smoke

April 23, 2012

By Julie Alipala

ZAMBOANGA CITY, Philippines— An Air Philippines flight to Tawi-Tawi was aborted on Monday morning as smoke emitted from the right engine of the plane, an official said.

Celso Bayabos, manager of the Civil Aviation Authority of the Philippines in Zamboanga, said the plane was about to take off when pilots noticed the smoke prompting them to park and order around 50 passengers to disembark shortly after 7:00 in the morning.

“It’s not really fire, there was smoke. It’s good that pilots noticed it before they take off otherwise (it would be) another disaster,” Bayabos said

Other flights supposedly about to land at Zamboanga City international airport like Cebu Pacific from Davao city and Manila were advised to redirect their flights back.

Fire marshalls and other airport personnel immediately towed the aircraft back to the taxi area to determine the actual cause of engine trouble.

By Julie Alipala

ZAMBOANGA CITY, Philippines— An Air Philippines flight to Tawi-Tawi was aborted on Monday morning as smoke emitted from the right engine of the plane, an official said.

Celso Bayabos, manager of the Civil Aviation Authority of the Philippines in Zamboanga, said the plane was about to take off when pilots noticed the smoke prompting them to park and order around 50 passengers to disembark shortly after 7:00 in the morning.

“It’s not really fire, there was smoke. It’s good that pilots noticed it before they take off otherwise (it would be) another disaster,” Bayabos said

Other flights supposedly about to land at Zamboanga City international airport like Cebu Pacific from Davao city and Manila were advised to redirect their flights back.

Fire marshalls and other airport personnel immediately towed the aircraft back to the taxi area to determine the actual cause of engine trouble.

Iconic airplanes headed for scrapyard

Find a new home for "Connie" petition on

By Recto Mercene

April 21, 2012

FOR

a country that prides itself in having mounted the first commercial

flight in Asia in 1941, and also the first Asian airline to cross the

Pacific Ocean in 1946—transporting World War II troops from Manila to

Oakland, California—it seems strange that the Philippines does not have

an aircraft museum.

We need a place to display these aircraft to remind the world, or at least the younger generation of Filipinos, of our small but crucial contributions to the growth of aviation in our neck of the woods.

This little oversight could be redeemed if someone out there with a small capital could finance the acquisition of a score of “iconic” airplanes, now in various stages of deterioration at an airplane “graveyard” of the Ninoy Aquino International Airport (Naia) compound.

Or maybe, the Philippine Amusement and Gaming Corp., with its deep pocket and social commitment, can buy these airplanes and make them part of its sprawling Entertainment City, now taking shape at the reclaimed portion of Roxas Boulevard.

Languishing in oblivion are scores of airplanes that Naia General Manager Jose Angel Honrado wanted to dispose of, seeing them as “eyesores and safety hazards.” He has given the owners 30 days before the Manila International Airport Authority (Miaa) imposes a charge of P32/square meter/month. He announced plans to eventually auction the airplanes.

Headed for the scrap yards—or the auction block—are five DC-9s, whose last owner is known only as “Orion”; four DC-3s; one Russian-made Antonov An-268; another Russian-made Yak-40; a Cessna 150 trainer-plane; and the most iconic of all, a Super Constellation, the plane that preceded the commercial jetliners of our age.

The “Connie,” as it was fondly called, is an American-registered plane, N427K, impounded by airport authorities in June 1988, allegedly for smuggling activities. It has been sitting at the compound since then. Its last owner was William “Winky” Crawford, who was reported to have died many years ago.

Weighed down by quarter-ton blocks of concrete to prevent it from being carried away by annual typhoons, this airplane has been ravaged by the elements. But part of its colorful history is that this is the airplane that was designed by legendary billionaire/genius/madman/Hollywood actor/lover boy Howard Hughes.

“It sure would be a shame if this aircraft gets cut up when there are folks out there who would like to give her a new home!” said one blogger.

The Miaa was recently granted legal ownership of the Super Connie N427K, after the failure of the owner to claim it. Another blogger said the plane was “one of the few remaining restorable Constellations and, in the past, there had been a number of organizations interested in acquiring the aircraft.”

“Hopefully, one of them is still willing and able to step up to the plate and provide a new home for this long-neglected veteran. Otherwise, the sad alternative is a date with the scrapman,” the blogger lamented.

The Super Constellation is the first pressurized airliner in widespread use. It helped usher in affordable and comfortable air travel.

Sleek and powerful, Constellations set a number of records. On April 17, 1944, the second production plane, piloted by Howard Hughes himself, and Transworld Airlines (TWA) President Jack Frye, flew from Burbank, California, to Washington, D.C., in six hours and 57 minutes at an average 330.9 mph (532.5 km/h).

On its return trip, the aircraft stopped at Wright Field to give Orville Wright his last flight, more than 40 years after his historic first flight.

“The Constellation’s wingspan is longer than the distance of my first flight,” Wright was quoted as having said.

The airplane’s elegant appearance is a result of its shapely fuselage, designed like a dolphin; unfortunately, this proved very expensive and was eventually replaced by the tube shape of today’s airliners, which is more resistant to pressurization changes. And cheaper to build, at that.

The same type of airplane had been Gen. Douglas MacArthur’s personal aircraft during the Korean War and named Bataan. Registered as N422NA it was flown to museum headquarters in Chino, California, in late 1994 and then to the museum’s annex in Valle, Arizona, in early 1995, where the aircraft remains on display as Bataan.

The Connie was a propeller-driven airliner powered by four 18-cylinder radial Wright R-3350 engines and built by Lockheed between 1943 and 1958. A total of 856 aircraft were produced in numerous models, all distinguished by a triple-tail design and dolphin-shaped fuselage.

Many are now refurbished in mint condition and displayed in various museums from Australia to Switzerland.

Four of the Douglas DC-3 at the Naia, under four owners, are now under the mercy of the elements. DC-3 is propeller-driven; its speed and range revolutionized air transport in the 1930s and 1940s. Its lasting impact on the airline industry and WW II makes it one of the most significant transport aircraft ever made.

The military version was designated the C-47. Many DC-3/C-47s are still used in all parts of the world. a total of 16,079 DC-3s were manufactured and as of 2011, 400 remained in commercial service.

Initially, Philippine Airlines (PAL) acquired six DC-3s from US military surplus in 1945, until eventually it had a fleet of 48 DC-3s, which sewed up the far-flung islands of the archipelago to usher in widespread commercial aviation. PAL retired this indestructible aircraft in 1978, after 32 years of service, according to Jonathan Gesmundo, the airline’s editorial consultant.

The four DC-3s at the Miaa are now in a deteriorated condition, although they could still be restored, since cannibalized parts are available in the black market, according to airport sources.

One locally owned DC-3 was bought by an African country in 2011. It was on its way to be delivered, but unfortunately crashed shortly after takeoff at the Naia.

The production of civil DC-3s ceased in 1942, while the military versions were produced until the end of the war in 1945.

December 17, 2010, marked the 75th anniversary of the DC-3’s first flight, and there are still small operators with DC-3s in revenue service and as cargo aircraft. The common saying among aviation buffs and pilots is that “the only replacement for a DC-3 is another DC-3.”

According to Wikipedia, the aircraft’s legendary ruggedness is enshrined in the lighthearted description of the DC-3 as “a collection of parts flying in loose formation.” Its ability to take off and land on grass or dirt runways makes it popular in developing countries, where runways are not always paved.

Some of the uses of the DC-3 included aerial spraying, freight transport, passenger service, military transport, missionary flying and sport skydiving shuttling and sightseeing.

The oldest DC-3 still flying is the original American Airlines Flagship Detroit (c/n 1920, No. 43 off the Santa Monica production line), Wikipedia says, adding it can be seen at airshows around the United States and is owned and operated by the non-profit Flagship Detroit Foundation.

The Yakovlev Yak-40 (Nato reporting name: Codling) is a small, three-engined airliner that is often called the first regional jet transport aircraft. It was introduced in September 1968 with Aeroflot.

It is unclear how the Yak-40 and the Antonov An 26B airplanes made it to the Philippines. It appears that following the breakup of the Soviet Union in 1982, cheap Russian-made airplanes were available and were bought by those on a shoestring budget to start small-scale commercial operations in the Philippines.

However, when the owners tried to register the airplanes with the-then Air Transport Office (Ato), the authorities found out that the airplane’s cockpit markings, including its airplane manuals, were in Russian.

The ATO required the owners to produce English versions of the manuals, but apparently none were available and the airplanes were left at the Naia graveyard, since flying them back to Russia would be more expensive.

Wikipedia says the Yak-40 is a low-winged cantilever monoplane with unswept wings, a large T-tail and a retractable tricycle landing gear. The passenger cabin is ahead of the wing, with the short rear fuselage carrying the three turbofan engines, with two engines mounted on short pylons on the side of the fuselage and a third engine buried in the rear fuselage.

The three AI-25 engines were two-shaft, had no jet pipes and initially no thrust reversers. The production of Yak-40 ended in 1981; the factory at Saratov had produced a total of 1,011 aircraft.

By 1993 Yak-40s operated by Aeroflot had carried 354 million passengers, Wikipedia says, adding that it was the backbone of Aeroflot’s local operations, flying to 276 domestic destinations in 1980.

An-26B is registered to Mosphil Aero as RP-C7205. It is a twin-engine turboprop military transport aircraft, designed and produced in the USSR on March 12, 1968.

It made its public debut at the 27th Paris Air Show at Le Bourget, where the second prototype, CCCP-26184 (c/n00202), was shown in aircraft parking lot. AN-26 is also manufactured without a license agreement in China by Xian Aircraft Factory as the Y-14, later changed to be included in the Xian Y7 series, according to Wikipedia.

The Cessna 150 being disposed of by the Miaa is registered as RP-C954 by its owner, Fredelito Juane. It is a twin-seater, single-engine aircraft of choice by flying schools for flight training, touring and personal use. It is the fourth most-produced civilian plane ever, with 23,838 produced, Wikipedia says.

Practically 99 percent of Philippine pilots since the 1960s were graduates of the C-150, including all PAL and regional captains, who all graduated from the PAL flying school, according to Gesmundo.

A forgiving and easy-to-fly airplane, the C-150 cost about $12,000 in 2007.

In Photo: Four DC-3s at the mercy of the elements at the Naia compound, a Super Constellation

and The Antonov An-26B, a Russian-made airplane now headed for the

auction block.

PAF seeks 12 F-16 fighter jets from US

April 19, 2012

Foreign Secretary Albert del Rosario said Wednesday that the Philippines will seek a

squadron of F-16 fighter jets and a third coast guard cutter, communications and electronics jamming equipment as well as modern weapons systems for its two new cutters that is scheduled for delivery.

"We

are upgrading the capacity of our armed forces and we are glad that the US government approved our request to acquire those fighter jets", says del Rosario who decline to reveal further details.

The jet deal would be

for second-hand F-16s block C/ D with the Philippines paying for reconditioning,

maintenance and pilot training which will run for two years, del Rosario added.

A recent naval stand-off between the Philippines and China has not gone unnoticed by the United States which agreed to immediately schedule high-level talks between Manila and Washington on April 30 to establish the country's “minimum defense posture” against aggressors.

Secretary del Rosario will be accompanied by Defense Chief Voltaire Gazmin who is scheduled to meet Secretary of State Hillary Clinton and Leon Panetta in Washington next week to

discuss the terms of the grant.

The Foreign Secretary said that the potential jet deal was raised during a visit last month by US Secretary

of State Hillary Clinton, who pledged a wide-ranging commitment to its

former colony, from military to economic cooperation.

The Philippines is

offering the United States greater access to its airfields in exchange for military hardware necessary for its defense.

The April 30 talks between and among foreign and Defense Officials will precede the meeting between U.S. President Barack Obama and

Philippine President Benigno Aquino later this year who is expected to issue the formal announcement.

Tiger Airways consolidates Seair Ownership

April 19, 2012

In a disclosure to the Singapore Stock Exchange, the carrier said it would amend the 2011 term sheet to hike

Tiger Airways Holdings Ltd.’s stake in Seair from 32.5 percent to 40

percent, equivalent to US$7 million.

In a disclosure to the Singapore Stock Exchange, the carrier said it would amend the 2011 term sheet to hike

Tiger Airways Holdings Ltd.’s stake in Seair from 32.5 percent to 40

percent, equivalent to US$7 million.

Singapore - Singapore Airlines subsidiary and low cost carrier Tiger Airways has announced plans to increase its stake in Southeast Asian Airlines (SEAir) Monday, April 16, as its foreign partner.

In a disclosure to the Singapore Stock Exchange, the carrier said it would amend the 2011 term sheet to hike

Tiger Airways Holdings Ltd.’s stake in Seair from 32.5 percent to 40

percent, equivalent to US$7 million.

In a disclosure to the Singapore Stock Exchange, the carrier said it would amend the 2011 term sheet to hike

Tiger Airways Holdings Ltd.’s stake in Seair from 32.5 percent to 40

percent, equivalent to US$7 million.

The disclosure said that the 2 parties have revised their term sheet, which was originally signed in February 2011.Tiger purchased a 32.5-percent stake in SEAir for $6 million. The additional 7.5-percent stake is worth $7

million, it said.

“The revised term sheet is to replace the first term sheet that was

signed on February 24, 2011. The parties will now proceed to finalize

the definitive sale and purchase agreement for the stake,” the airline said.

SEAir is the 5th largest airline in the Philippines dominated

by giants Philippine Airlines (PAL), Cebu Pacific, AirPhil

Express, and Zest Air. Spirit of Manila and Air Asia Philippines are the bottom two.

SEAir operates a pair of Airbus A320's and 4 Dornier 328's operating between Manila and Boracay gateway, Caticlan, and other feeder points, as well as flights from Manila-Clark to Hong Kong, Macau and Singapore.It has rights to fly Manila to Cebu and Davao and an application to fly 3 Malaysian destinations – Kuala Lumpur, Kuching and Kota Kinabalu from its hub in Clark. --with reports from Rappler

PAL to Start Kalibo Hongkong

Flight starts April 27

April 17, 2012

Philippine Airlines (PAL) will start direct flights from Hong Kong to Kalibo International Airport on April 27, 2012 using an Airbus A320 plane which seats 150 people.

In a statement, the airline said the twice weekly service is "aimed at further boosting market demand for Boracay."

PAL flight PR289 leaves Hong Kong every Tuesday and Friday at 1:20 p.m., arriving in Kalibo at 3:50 p.m. The return flight, PR290, departs Kalibo at 4:50 p.m., arriving in Hong Kong at 7:20 p.m.

300-M passengers for 70 years

April 16, 2012

From a full load of five passengers on its maiden flight to Baguio

back in 1941, Philippine Airlines (PAL) as of April 14, 2012, has

carried more than 300 million passengers over the last seven decades – a

feat unequalled by any other local carrier.

From the few brave Filipinos who ventured trying the then novel mode

of air transport, today's regular air travelers – overseas Filipino

workers, vacationing families, tourists and businessmen – still prefer

flying PAL, if not for the flag carrier's modern fleet of airplanes but

especially for the warm and distinctively Filipino cabin service.

With number of passengers projected to increase by 12%, PAL expects

to breach the 10-million-passenger mark by end of 2012. Passenger load

factor is likewise expected to improve to about 80% for 2012.

With such bright prospects, the airline recently unveiled a new

marketing tact that aims to make passengers fall in love with PAL all

over again.

"Love, Your PAL" is meant to show PAL's gratitude to its 300 million

passengers as well as an invitation for other air travelers,

particularly foreigners, to renew ties with the national flag carrier

which has embodied the best that the Philippines can offer to the world.

"Love, Your PAL" will be PAL's signature for all domestic and

outbound communications, providing the emotional message to make

Filipinos fall in love with PAL again. The campaign was launched during

PAL's 71st founding anniversary last month.

For the past 70 years, PAL has been the biggest carrier for inbound

tourists. Through the new marketing campaign, PAL wants foreign

travelers/visitors to fly only the flag carrier because PAL is the

showcase of the Philippines.

The airline is the only Philippine-based carrier that flies

regularly to North America, Australia and India and offers the most

convenient schedules for major regional destinations such as Japan,

China, Korea

and Southeast Asia.

PAL has flown over 300 million passengers safely and comfortably in

all routes, and hopes to excite the market with new programs that will

strengthen loyalty of its passengers.

As opening salvo of the "Love, Your PAL" marketing campaign, an

anniversary sales promo offered big discounts on the purchase of second

tickets to selected destinations.

Forthcoming are PAL's involvement in the Philippine premier of the

Broadway musical Phantom of the Opera as well as in the Hollywood

commercial screening of the first Filipino full-length film, The Road

by GMA Films.

At the PAL anniversary, six of the airline's best flight

stewardesses who epitomize the unique beauty and charm of the Filipina –

called the PAL Charisma Girls – were introduced. The Charisma Girls,

showing the distinct character of PAL, is a take off from the highly

successful 1986 PAL advertising campaign that showcased the "Beauty of

the Philippines Shining Through".

Philippine Airlines and AirPhil outlook improves as new ownership cements two-brand strategy

April 13, 2012

Philippine Airlines (PAL) and low-cost sister carrier AirPhil Express

are embarking on a new but still challenging era following the sale of

large minority stakes in the two companies to Filipino conglomerate San

Miguel. While Lucio Tan will continue to control majority stakes in both

airlines, the deal is significant as it provides USD500 million

required for fleet renewal and reinvigoration at PAL and for expansion

at AirPhil,

which will be used to fight off increasing LCC competition. It is also

significant as San Miguel will gain management control of both carriers,

which could lead to some adjustments in the group’s strategy.

Philippine Airlines (PAL) and low-cost sister carrier AirPhil Express

are embarking on a new but still challenging era following the sale of

large minority stakes in the two companies to Filipino conglomerate San

Miguel. While Lucio Tan will continue to control majority stakes in both

airlines, the deal is significant as it provides USD500 million

required for fleet renewal and reinvigoration at PAL and for expansion

at AirPhil,

which will be used to fight off increasing LCC competition. It is also

significant as San Miguel will gain management control of both carriers,

which could lead to some adjustments in the group’s strategy.The deal, which was completed last week, hardly comes as a surprise. On numerous occasions Mr Tan has looked to sell part of his stake in PAL, of which he took control 20 years ago after the flag carrier was privatised. The latest round of negotiations with San Miguel and one other potential buyer have been dragging on since late last year. Industry sources say Mr Tan was initially reluctant to include AirPhil, which has a brighter outlook than PAL given its focus on the faster growing budget end of the market, and cede management control in either carrier.

While San Miguel and PAL parent Trustmark Holdings have announced the

deal will involve Trustmark and AirPhil parent Zuma Holdings issuing

new shares in the two carriers to San Miguel Equity Investments, they

have not confirmed exactly how large a stake will change hands.

Reportedly San Miguel will end up with stakes between 40% and 49% in

both carriers. Zuma now owns all of AirPhil Express while Trustmark owns

nearly all of PAL (Trustmark’s control of PAL is estimated to be 97% to

98% as a small minority share in PAL is publicly traded on the Philippine Stock Exchange). Mr Tan controls both Zuma and Trustmark.

PAL could adopt similar strategy to Garuda

PAL is among the weakest of Asia’s major flag carriers, having seen

its share of the Philippine market steadily erode in recent years, and

was in need of a recapitalisation. With the USD500 million coming from

San Miguel, the carrier will be able to embark on a new business plan

that will likely follow a strategy similar to the one used by

similarly-sized Garuda Indonesia. As part of its Quantum Leap business plan for 2011 to 2015, Garuda is investing in rapid expansion at budget brand Citilink as well as in improving its full-service offering through fleet renewal and premium product enhancements.

Garuda is also now in the process of joining the SkyTeam

alliance, which has required a complete overhaul of the carrier’s IT

systems. Joining a global alliance, upgrading IT systems and adding more

codeshare partners will likely become an important component of the

medium to long-term strategy at PAL as the flag carrier looks to expand

its international network and improve its premium product.

PAL has said it plans to use the funds coming from San Miguel to renew its fleet, particularly its ageing Boeing

747-400s. PAL already has four additional 777-300ERs on order, which

are slated for delivery in 2H2012 and 2013. Some of the USD500 million

will likely be used to complete the acquisition of these aircraft while

new widebody and narrowbody orders, including for the A320neo, are also

possible.

PAL cannot compete directly with the country’s fast-growing LCC sector...

PAL

will also likely invest in improving its product in both cabins,

particularly business, through upgraded in-flight entertainment, new

seats and other enhancements. While the Philippine premium market is

relatively small, PAL cannot compete directly with the country’s fast-growing LCC sector

given its higher unit costs and legacy structure. It needs to

differentiate the main PAL brand from local competitors, which are all

LCCs and only offer economy class.

Like Garuda, PAL is no longer the largest carrier in its home market (in Indonesia, Lion Air now carries the most passengers while in the Philippines, LCC Cebu Pacific

carries more passengers). PAL has seen its share of the domestic market

slip to about 20%, based on current capacity, while its share of the

international market has slipped to about 25%.

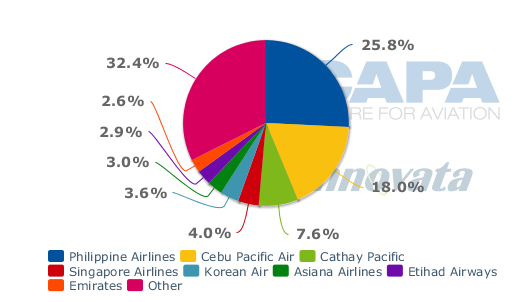

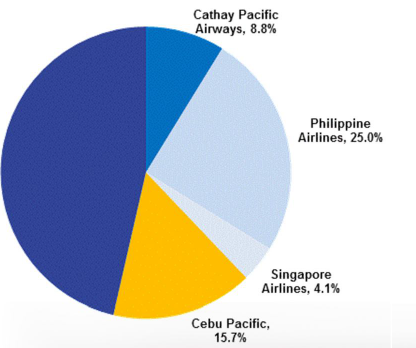

Philippines international capacity share (% of seats) by carrier: 09-Apr-2012 to 16-Apr-2012

Philippines domestic capacity share (% of seats) by carrier: 09-Apr-2012 to 16-Apr-2012

Source: CAPA – Centre for Aviation & Innovata

Note: Excludes AirAsia Philippines

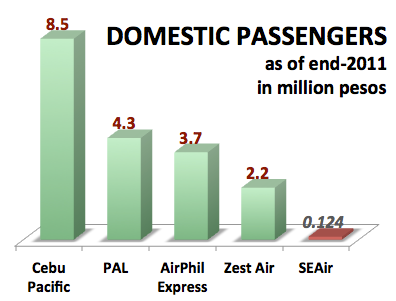

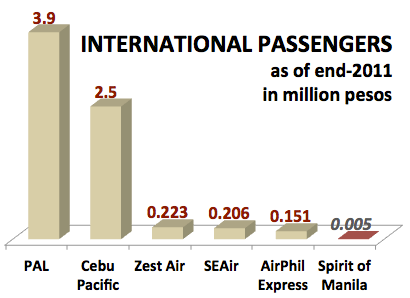

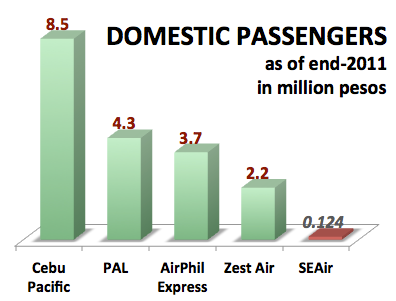

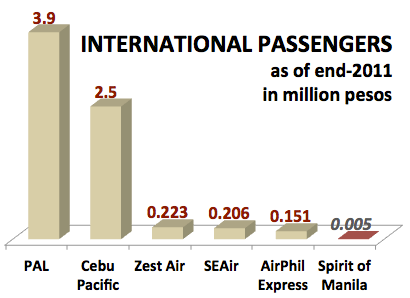

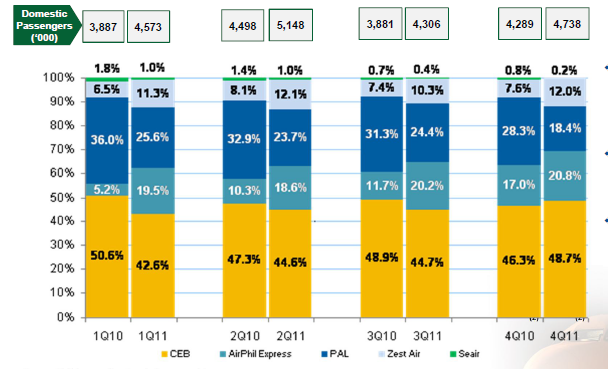

According to Philippine CAB data for 2011, Cebu

carried 45% of the 19 million domestic passengers that were transported

in the Philippines last year, compared to 24% for PAL and 20% for

AirPhil Express. In the international market, PAL flew 25% of the nearly

16 million passengers while Cebu accounted for 16% (see Background

information).

While PAL plans to maintain its presence in domestic and regional

international markets to meet the needs of premium and connecting

passengers, the carrier will likely look to focus primarily on long-haul

markets as it invests in renewing its widebody fleet. Cebu Pacific

plans to launch its own widebody operation next year but this operation

will focus on medium-haul routes to Australia

and the Middle East and only offer economy class. As a result, there is

still an opportunity for PAL to capitalise on its position as the only

Philippine carrier operating long-haul routes and the only local carrier

with a premium product.

Alliance membership and an improved product with a modern fleet could

help PAL find a profitable niche, particularly as the Philippine

economy and tourism sector grow. But there are still numerous challenges

confronting PAL’s long-term viability even though it now has the cash

to survive the current crisis and invest in improving its product.

Gulf carriers limit PAL’s network opportunities in the Middle East and Europe

The Philippines market is now very well served by Gulf carriers, which has already forced PAL to withdraw entirely from the Middle East. PAL also no longer offers services to Europe and is unlikely to enter the market given its inability to compete with the Gulf carriers. KLM, the only European carrier still servicing the Philippines, also recently dropped its non-stop Amsterdam-Manila service for a one-stop Amsterdam-Taipei-Manila offering.

Emirates, Etihad, Qatar Airways and Saudi Arabian combined account for 23% of international ASKs from the Philippines, which is almost as much as the 30% international ASK share held by PAL. In terms of seats, Emirates, Etihad, Qatar and Saudi Arabian have a relatively strong 10% share of the market (all four carriers are among the largest 10 foreign carriers serving the Philippines; Kuwait Airways also serves Manila but with a much smaller operation).

Gulf carriers have a dominant position in the local Philippines-Middle East market and a strong position in the one-stop Philippines-Europe market. Both these markets are big as there are about 2.5 million expatriate Filipinos working in the Middle East and another 1 million in Europe. There is also growing demand from leisure passengers from the Middle East and Europe as the Philippines has started to emerge as a major tourist destination.

Philippines international capacity share (% of ASKs) by carrier: 09-Apr-2012 to 15-Apr-2012

Source: CAPA – Centre for Aviation & Innovata

PAL’s outlook clouded by current inability to expand in the US market

The strength of PAL’s long-haul network is now North America, where the carrier makes most, if not all, of its profits. But FAA Category 2 restrictions currently prevent PAL from adding flights to the US or even deploying its two 777-300ERs on existing US flights. There has been some indication that the Philippines will regain its Category 1 status later this year and PAL has tried to expedite this effort by paying for a consultant firm which is helping Philippine authorities meet Category 1 requirements.But Category 1 is far from guaranteed and this uncertainty clearly reduces the value of PAL. In fact, in some respects it is surprising San Miguel has agreed to invest in the carrier while Category 2 restrictions are in place.

Without Category 1, PAL will struggle to find homes for its four additional 777-300ERs on order. Without Category 1, the carrier cannot proceed with its long-delayed plans to add capacity to its three existing US mainland destinations – Los Angeles, San Francisco and Las Vegas (it also serves Honolulu and Guam) – and add new US gateways such as San Diego. Under Category 2, PAL also cannot codeshare with a US carrier, which could dilute its attractiveness to alliances.

In Australia, which also has a relatively large population of Filipinos, PAL faces the prospect of competing with Cebu when it launches its A330 operation in mid-2012. There is also a possibility of long-haul low-cost services from Jetstar.

PAL faces prospect of increased LCC competition on North Asian routes

PAL will also see LCCs eat into its relatively strong position in North Asia as key North Asian markets liberalise. Cebu already has a larger share of capacity than PAL on international routes within Southeast Asia, where it has had fairly unfettered access. But the more restricted North Asia market is a vastly different story. PAL currently accounts for 29% of capacity between the Philippines and North Asia while Cebu has an 18% share, according to Innovata data.Given the Philippines central geographic position, all major cities in North Asia and Southeast Asia are within the range of narrowbody aircraft. Cebu Pacific has been gradually expanding in North Asia as opportunities arise and is expected to significantly improve its 18% market share as the region continues to liberalise.

...competition is already intense in the Philippines-Korea market with five LCCs and four full service carriers...

Cebu

Pacific particularly sees opportunities in the mainland Chinese and

Japanese markets. Some growth is also expected in Korea, which is the

largest source of tourists for the Philippines. But competition is already intense in the Philippines-Korea market with five LCCs and four full service carriers. Cebu Pacific is already the leading LCC between the Philippines and Korea, with an 18% share of total capacity. PAL (22%), Korean Air (25%) and Asiana (21%) are all larger, suggesting there could be opportunity for further LCC growth at the expense of PAL.To Japan, Cebu Pacific now only operates one route (Manila-Osaka) and accounts for less than 3% of total capacity compared to 46% for PAL. Expansion by Philippine carriers in Japan is currently prohibited by Japan’s JCAB. But Cebu Pacific executives told analysts last month during its 4Q2011 earnings call that there are discussions between Japanese and Philippine regulators about removing this restriction, which is somewhat linked to Category 2 in the US. Cebu Pacific is now confident the Japanese restriction will be lifted, at least for carriers that already serve Japan, regardless of the outcome with Category 2 in the US.

Cebu Pacific chief executive advisor Garry Kingshott says the carrier has been very successful in Osaka and capacity expansion opportunities in Japanese markets other than Tokyo could easily support full-time allocation of two to three additional A320s. He sees sufficient demand for more capacity to Osaka as well new services to Fukuoka and Nagoya. Securing rights to Tokyo could be more challenging but Mr Kingshott sees the launch of two new Narita-based LCCs later this year, Jetstar Japan and AirAsia Japan, potentially opening up the Tokyo-Manila market to Cebu Pacific as Philippine authorities would request reciprocity in the event that a Japanese LCC asks to serve the route. Cebu Pacific is confident it can compete well with PAL and Japanese LCCs on the Tokyo route given its significantly lower cost structure.

This gives PAL a huge advantage that will not likely be maintained...

Cebu Pacific is now limited to three weekly flights on Manila-Osaka while Jetstar Asia late last month launched service on the route with four weekly flights that originate in Singapore. Jetstar also has just launched four weekly flights between Manila and Tokyo Narita (which originate in Darwin), illustrating the huge untapped potential for LCCs in the Philippines-Japan market. PAL serves four Japanese destinations – Fukuoka, Osaka, Nagoya and Narita – but does not currently face any competition on two and has very limited LCC competition on the other two. This gives PAL a huge advantage that will not likely be maintained.

Cebu Pacific is also bullish on the China market and believes LCCs are well positioned to capture most of the growth between mainland China and the Philippines. The carrier last month launched service to Xiamen, its fourth destination in mainland China. Mr Kingshott says there are “a number of markets in China that have come on to our radar screen”. There are generally no restrictions on the carrier launching flights to new secondary destinations in China. But expanding in Beijing, Shanghai and Guangzhou is challenging given the slot constraints at China’s major airports (Cebu currently has one flight to Shanghai, four weekly flights to Beijing and three weekly flights to Guangzhou).

PAL now has a leading 40% share of the Philippines-mainland China market, based on current capacity. In comparison, Cebu Pacific has a 23% share.

Cebu Pacific has a similar 22% share of capacity in the humongous Philippines-Hong Kong market, which is more than double the size of the Philippines-mainland Chinese market. Cathay Pacific has a leading 42% share of this market followed by PAL with a 25% share. (In the smaller Philippines-Macau market, Cebu is currently much larger than PAL.)

Cathay Pacific is a formidable competitor to PAL

Hong Kong-Manila is Cathay’s fourth largest route by capacity

(seats), the largest international route for PAL and the second largest

international route for Cebu Pacific. Cathay’s leading market share

between the Philippines and Hong Kong (it is 45% when including its

regional subsidiary Dragonair)

reflects the group’s big presence in the greater Philippines-North Asia

and Philippines-North America markets. Cathay is PAL’s biggest

competitor on the premium end of these markets and will remain a major

player in the Philippines.

It is by far the largest foreign carrier in

the Philippines, with an 8% share of current international capacity.

As it carries a large chunk of premium passengers travelling between

the Philippines and North Asia or North America, Cathay will likely be

the biggest target for PAL as it looks to improve its premium offering.

Korean Air, Asiana, Japan Airlines, All Nippon Airways, China Airlines, EVA Air and Delta Air Lines

(which serves Manila via Tokyo) also play in the Philippines-North Asia

and Philippines-North America premium markets but they all have a much

smaller presence in Manila than Cathay.

Philippines to North Asia capacity by carrier (seats per week, one way): 19-Sep-2011 to 30-Sep-2012

Source: CAPA – Centre for Aviation & Innovata

PAL’s key advantage in the Philippines-North American market is its ability to offer non-stops. PAL is currently the only carrier operating non-stop flights to the mainland US and Canada but currently faces restrictions on its US flights due to Category 2.

PAL is now forced to include fuel stops on some of its westbound

flights from the US due to range/payload issues. This would not be an

issue if it was able to replace 747-400s and A340-300s with 777-300ERs

on its US flights – something it desires to do but cannot due to

Category 2 restrictions.

Non-stops are particularly critical to premium passengers. With

non-stop flights and an upgraded premium product, PAL should be able to

hold its own, especially if it succeeds at joining a global alliance. An

expanded operation to North America would also help feed PAL’s routes

to Southeast Asia, which are struggling due to the intense LCC

competition.

PAL needs to expand in North America and improve its product in the

market with 777-300ERs as its current advantages in North Asia will be

eroded as LCCs start to make inroads in the Japanese and Chinese

markets. PAL primarily uses widebody aircraft on its North Asian routes,

partly because of the high demand on these sectors due to the absence

of LCC competition but also because of the current restrictions on

expanding in the US. North Asia is a huge market for PAL, accounting for

nearly half of its international seats. But on an ASK basis, North

America is already PAL’s biggest market, accounting for two-fifths of

ASKs.

Philippine Airlines capacity by region (seats per week): 09-Apr-2012 to 15-Apr-2012

Source: CAPA – Centre for Aviation & Innovata

AirPhil has brighter outlook than PAL

AirPhil generally has a better outlook as most of the growth in the

Philippines is at the lower end as it is a market dominated by leisure,

migrant worker and visiting friends and relatives (VFR) traffic. But the

Philippines LCC sector is also very crowded and is already seen by some

as oversaturated. With financial support from San Miguel, AirPhil is

now in better shape to withstand the war now being waged between

Philippine LCCs.

With insisting that AirPhil was included in the sale of PAL, San

Miguel recognised the value of AirPhil and the need to adopt a

multi-brand strategy. AirPhil will be the brand used to grow

domestically and in regional international markets. Growth at PAL will

be relatively limited with the exception of North America, where

significant capacity will be added if and when Category 2 restrictions

are lifted.

AirPhil has been used as PAL’s budget brand since early 2010, when the Air Philippines

name was dropped and the carrier adopted the LCC model. At the time,

Air Philippines was only operating Dash 8 turboprops on behalf of PAL.

AirPhil continues this regional domestic operation, in which it competes

primarily against Cebu’s ATR

72s to airports that cannot be accessed by jets, but after the

re-branding also started competing on domestic trunk routes using A320s

sourced from PAL.

AirPhil top 10 routes by capacity (seats per week): 09-Apr-2012 to 15-Apr-2012

Source: CAPA – Centre for Aviation & Innovata

AirPhil codeshares with PAL on its turboprop routes while on the

trunk routes it generally operates alongside PAL, with AirPhil focusing

on the lower end of the market and PAL focusing on premium and

connecting passengers. AirPhil’s traffic doubled last year to about 4

million passengers. Cebu transported just under 12 million passengers in

2011. It has more than doubled its traffic in only four years, from 5.4

million in 2007.

AirPhil now operates 11 A320s and prior to the ownership change had a

strategy in place for steady expansion of three to four additional

A320s p/a. The new funding from San Miguel will support the acquisition

of these aircraft and could potentially lead to an acceleration of the

expansion at AirPhil.

The carrier currently only operates five scheduled international routes, including daily services on Manila-Singapore and Cebu-Hong Kong plus low frequency services from Kalibo to Beijing, Hangzhou and Shanghai. AirPhil also operates international charters and has one A320 dedicated to running charters between Clark International Airport

outside Manila and China. AirPhil has been expecting to focus more on

international expansion once it has built up a larger domestic base.

AirPhil plans to expand international operation from secondary cities

Scheduled flights to several destinations in China, Korea and Japan

are in the carrier’s medium-term plan. But AirPhil’s strategy envisions

operating these flights primarily from Clark

and other secondary airports in the Philippines. This strategy is

primarily due to congestion and lack of space at Manila. But by not

operating a significant number of international flights at Manila, the

carrier will also avoid competing head to head with PAL.

AirPhil particularly sees an opportunity at Clark, which has its own

large catchment area which encompasses the heavily populated northern

suburbs of Manila. Earlier this year AirPhil began domestic operations

at Clark, where it now operates four domestic routes according to

Innovata data. AirPhil does not currently have any scheduled

international flights at Clark but is planning to launch service on the

highly competitive Clark-Singapore route next month. Clark-Singapore is

already served by Tiger Airways/SEAir and Cebu Pacific and is expected to be served by AirAsia Philippines by the end of this year.

New LCCs such as AirAsia Philippines will also have to focus on Clark

due to the lack of space at Manila. As the country’s first LCC, Cebu

has an advantage in that it already has a large presence at Manila. But

Cebu also has some international flights at Clark and has been building

up its operations in other cities, including new point-to-point domestic

routes which bypass Manila.

AirPhil/Air Philippines has been a sister carrier to PAL since the

late 1990s, when Mr Tan purchased the carrier. But the companies have

always been separate with different boards and management. More

cooperation has been pursued since the 2010 re-branding and once San

Miguel takes over management control of the carrier more ties between

the carriers could be pursued. AirPhil has been following the last two

years a strategy similar to Jetstar but AirPhil is not yet fully

exploiting synergies with PAL as is the case with Jetstar and Qantas.

AirAsia Philippines launch further intensifies competition in the Philippines

AirAsia Philippines launched services last month, becoming the country’s fifth LCC after Cebu Pacific, AirPhil, Zest and SEAir/Tiger.

The new AirAsia affiliate is now operating domestic services from Clark

and plans to launch international services later this year.

Zest currently operates both domestic and international routes.

SEAir, in addition to operating turboprops under a domestic regional

carrier model, now operates two A319s on international routes under an

LCC model and as part of a marketing tie-up with Tiger Airways. The two

carriers have been discussing extending this partnership to include

A320s, an equity stake and domestic trunk routes.

...they aim to close the gap with market leader Cebu Pacific...

AirPhil, Zest and AirAsia Philippines are all planning rapid growth this year as they aim to close the gap with market leader Cebu Pacific,

which also claims to be the country’s only profitable LCC. AirPhil,

Zest and AirAsia Philippines plan to add about seven aircraft this year,

giving the trio a fleet of 35 A320 family aircraft by the end of 2012.

Cebu plans to add four A320s, giving the carrier a fleet of 33

A319s/A320s by year-end. There are also seven foreign LCCs currently

serving the Philippines

Cebu Pacific says it plans to grow capacity by 12% in 2012 and

continue expanding at this pace over the next five years as it grows its

A320 fleet to 52 aircraft by the end of 2017. Cebu executives expect

domestic capacity to grow by 10% to 12% p/a over the next several years

while regional international capacity grows by 15% to 20% p/a. This

excludes its new medium/long-haul division, which will start operations

in 3Q2013. The first of eight A330s are slated for delivery to Cebu

Pacific in Jun-2013.

Cebu Pacific long-haul operation will likely not impact PAL significantly

While Cebu’s decision to add widebodies likely led to an immediate

decrease in the value of PAL just as the flag carrier was looking for a

new owner, the impact of the new Cebu Pacific widebody operation on PAL

may not end up being that significant. Cebu Pacific management is

adamant the carrier will not follow a hybrid model. Instead the carrier

will stick to a pure low-cost model with 400-seat A330-300s in

all-economy configuration. Cebu Pacific management also says they have

no intentions to forge codeshares and are unlikely to add interline

agreements. Currently Cebu Pacific has one limited interline agreement,

with Hawaiian Airlines.

Cebu Pacific management also does not envision Cebu Pacific launching

services to Europe or North America. Most European and North American

routes from Manila (Hawaii and Moscow would be the only logical

exceptions) would require a one-stop service given the range of Cebu’s

A330-300. Cebu Pacific says it is not interested in operating one-stop

flights as they are too complex. Cebu Pacific previously studied using

its A320s to serve Sydney or Melbourne with a stop in Darwin but concluded it is hard to make money on one-stop services under the low-cost model.

Hawaii would be within range but Cebu Pacific management say it is

unlikely the carrier will serve the Hawaii market. This is good news for

PAL and Hawaiian Airlines, both of which operate between Honolulu and

Manila.

Cebu Pacific management is primarily targeting the Middle East, particularly Saudi Arabia with three potential destinations along with the UAE

and Qatar. While all these markets are now served from Manila by Middle

Eastern carriers, Cebu Pacific says there is not sufficient capacity

given the large number of Filipinos living in the Middle East and that

most expatriate workers are opting for less expensive one-stop services.

With its low-cost structure, Cebu Pacific believes it can match or

undercut the fares on these one-stop services while offering a non-stop

product which will appeal to Filipinos. Cebu Pacific management believes

it can achieve a 35% cost advantage compared to other carriers on

routes to the Middle East but says on longer routes this is not

achievable at current fuel prices.

As Cebu Pacific is not interested in

launching routes unless it can achieve such a cost advantage, the

carrier’s new long-haul division plans to stick to medium-haul or

shorter long-haul flights, primarily Middle East and potentially

Australia.

PAL should be able to maintain its role as the only Filipino carrier in the key North America market...

Given

Cebu’s intentions with its new long-haul low-cost division (it does not

plan to apply for a separate operators certificate), PAL should be able to maintain its role as the only Filipino carrier in the key North America market.

In addition to the US, PAL also serves Canada, which has a large

Filipino population and does not suffer from Category 2 restrictions.

PAL it appears will also be able to maintain its position as the only

Philippine carrier offering a premium product and following a network

model. While premium demand in the Philippines is relatively limited,

the country’s economy and high-end inbound tourism are growing. If PAL

can improve its premium product and join a global alliance, it should be

able to compete better with foreign full service carriers serving the

Philippines.

There are huge risks facing PAL, including the possibility of the

Philippines remaining in Category 2. PAL may also have trouble

persuading a global alliance to accept the carrier. Securing a new major

shareholder with deep pockets means PAL now faces a much more certain

future. But many of its challenges remain and PAL has a lot of work hard

work ahead if it wants to leave the bottom tier of Asia’s flag

carriers.

International traffic share (% of passengers) in the Philippines: 2011

Source: Cebu Pacific, using Philippine CAB data

Domestic traffic share (% of passengers carried) in the Philippines by carrier: 2011 vs 2010

Source: Cebu Pacific, using Philippine CAB data

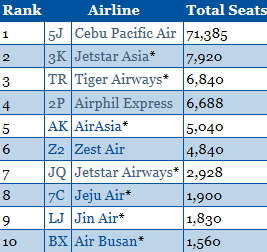

LCC capacity (seats per week) by carrier in the Philippines: 10-Apr-2012 to 17-Apr-2012

*denotes foreign carrier Source: CAPA – Centre for Aviation & Innovata

PH Airlines Banned in EU....

April 12, 2012

Who Is Checking If Your Airline is Safe?

|

Slutsky Maxim/ITAR-TASS Photo/Corbis

aircraft of the Utair airlines near Tyumen |

Even though the crash of a Russian airliner

in Siberia last week continues a pattern of disasters in that country

involving aging airplanes, poor maintenance, and sloppy regulation,

there are other parts of the world where boarding a flight is more

risky. For example, the Philippines and Africa.

The European Union has just updated its blacklist of airlines

and continues a blanket ban on all carriers from the Philippines. It

also lists scores of African airlines, where the worst record is held by

the Republic of Congo.

However, these two black spots send very different messages about what is wrong.

In Africa, a combination of political corruption, civil wars,

numerous rogue carriers, airplanes at the end of their life cycles, and

no continent-wide safety culture means that there won’t be improvements

any time soon.

The Philippines, on the other hand, shows what happens when a

potentially rich market is opened up to carriers following western

budget-airline business models without the infrastructure to support

them.

You end up with a kind of Potemkin Village on the runway: new

airplanes, splashy logos, and snappily dressed flight attendants masking

serious deficiencies like negligent regulators and an acute shortage of

experienced pilots.

And worse: aircrew taking drugs. In February, a pilot of Lion Air, a major Indonesian carrier, was arrested for possession of crystal meth; in the past eight months, three other Lion Air pilots have been arrested on drugs charges, and a flight attendant who went public with charges of pilots regularly taking drugs said she received death threats

.

Although Lion Air is on the European blacklist, another major

Indonesian carrier, Garuda, has met the European standards—having been

forced, after a series of crashes, to pass a rigorous review.

There is clearly an urgent need for a worldwide standard to determine when an airline should be banned for safety reasons.

The two most rigorous regulators, the European Union and the FAA in

the U.S., use very different methods. Europe bans airlines, the U.S.

bans countries.

But they share no common or consistent standard.

For example, while Europe has the total ban on the Philippines, the

FAA allows Philippine Airlines (PAL) to fly into the U.S. but remains

skeptical of efforts made by the Civil Aviation Authority of the

Philippines to clean up its act. Carriers from the Philippines are under

the FAA’s Category 2 watch, which means that they can fly existing

routes into the U.S. but not add either routes or change to larger

airplanes and are subject to heightened surveillance.

The latest European blacklist, meanwhile, for the first time includes

the Venezuelan airline Conviasa, cited for a record of accidents and

safety issues raised after checks of the airplanes made at European

airport.

And in an unusual step, Libya, where the airline infrastructure has

yet to recover from the civil war, has agreed with European regulators

not to resume flying into European airports until at least late

November. Technically, this is not a ban and, in any case, Libyan

Airlines seems able to circumvent this agreement by leasing an airplane

from a European carrier—complete with a crew and including maintenance

resources—and fly to London, Vienna, Athens, and Rome.

What should the concerned traveler take away from this far from perfect system?

As long as you book a flight on an airline operating out of the U.S.,

you can be sure it has passed an FAA safety audit. But if that flight

connects to an airline not operating in the U.S., you will need to check

the far more extensive blacklist published by the Europeans. Even then,

the E.U. only has power to ban airlines flying into European air space,

which leaves hundreds of airlines that are not caught in either of

these two safety regimes.

So what we have here is a global business without effective global

oversight. One body that is supposed to be global in its powers, the

International Civil Aviation Organization, ICAO, like other United

Nations agencies, is hidebound by bureaucracy and international

political sensitivities.

In contrast, the European Union’s blacklist reflects a political

culture that is aggressive (and, many would argue, too intrusive) on all

consumer-protection issues to a degree that would be impossible in the

U.S. And in the U.S. the FAA’s technical staff, no matter how skilled

and dedicated, are limited in their powers by political appointees who

are notoriously susceptible to industry pressures.