November 5, 2012

Philippine Airlines Group takes a step back

as budget brand drops several major domestic routes

The Philippine Airlines (PAL) Group is implementing a misguided new

strategy that involves its budget airline subsidiary pulling off several

domestic trunk routes. AirPhil Express, which is planning to be soon

re-branded as PAL Express, has redeployed capacity from trunk to leisure

and secondary routes, which it has taken over from PAL following a

surprising decision by the Group that the two brands should remove

nearly all overlap in their route networks.

The move, implemented

on 28-Oct-2012, goes against the grain of typical two-brand strategy at

Asian airline groups, which have discovered that they can successfully

use their LCCs to operate alongside their full service brand. As

Philippine Airlines and AirPhil Express (soon PAL Express) brands cater

to different sectors of the market, the two should be able to co-exist

on trunk routes with minimal cannibalisation. Most crucially, PAL Group

needs the second budget brand on domestic trunk routes to compete with

rival LCCs. The Philippines has a crowded and intensely competitive LCC

sector and it will be the Philippines’ four other LCCs that stand to

gain the most as the PAL Group removes its budget brand from several of

the country’s largest domestic markets.

AirPhil continues to

offer about 114,000 weekly domestic seats, giving the LCC about a 21%

share of the Philippine domestic market. It remains the second largest

domestic carrier and second largest LCC in the Philippines, behind

market leader Cebu Pacific. But on 28-Oct-2012 AirPhil pulled out of

seven major domestic routes from its Manila hub – Bacolod, Cebu, Davao,

General Santos, Iloilo, Laoag and Tagbilaran.

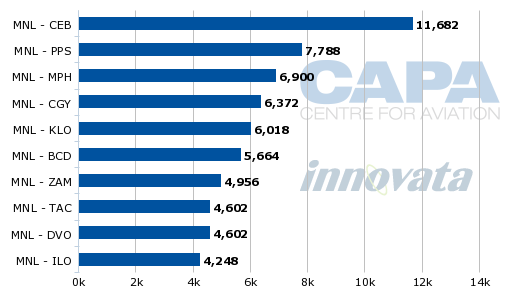

AirPhil Express drops five of its 10 largest routes

Five

of these are among the 10 biggest domestic routes in the Philippines

with Manila to Cebu, Devao and Iloilo being the three largest in the

country. Five of these routes were also previously among AirPhil’s 10

largest routes (see Background Information).

| Route |

Market

ranking* |

AirPhil

prior

ranking* |

AirPhil

prior

cap share |

PAL

prior

cap share |

PAL

current

cap share |

Competitors and

their current capacity shares |

| Manila-Cebu |

1 |

1 |

17% |

31% |

39% |

Cebu (42%), Zest (8%), SEAir (11%) |

| Manila-Davao |

2 |

9 |

12% |

28% |

38% |

Cebu (41%), Zest (11%), SEAir (10%) |

| Manila-Iloilo |

3 |

10 |

14% |

25% |

29% |

Cebu (46%), Zest (19%), SEAir (6%) |

| Manila-Bacolod |

8 |

6 |

23% |

31% |

43% |

Cebu (46%), SEAir (11%) |

| Manila-Tagbilaran |

10 |

8 |

18% |

32% |

52% |

Cebu (15%), Zest (33%) |

| Manila-General Santos |

14 |

* |

20% |

31% |

44% |

Cebu (56%) |

| Manila-Laoag |

21 |

* |

19% |

49% |

73% |

Cebu (27%) |

PAL has added capacity in all

seven routes dropped by AirPhil but in almost cases has not added as

much capacity as AirPhil has dropped. In some cases, the amount of

capacity PAL has added is significantly less than the capacity AirPhil

dropped, resulting in market share gains for PAL's LCC competitors.

Overall

PAL has reduced its domestic capacity by about 10% as the network

changes were implemented, from about 106,000 seats for the week

commencing 22-Oct-2012 to about 95,000 weekly seats for the week

commencing 29-Oct-2012.

While PAL has added seats on the seven

routes dropped by AirPhil, this does not entirely offset the seats it

had offered on the routes it has dropped and handed over to AirPhil. In

addition, PAL reduced capacity on a few routes in which for now both the

AirPhil and PAL brands continue to operate alongside each other.

| Route |

Market

ranking* |

PAL prior

capacity share |

AirPhil prior

capacity share |

AirPhil current

capacity share |

Competitors and

their current capacity shares |

| Manila-Puerto Princesa |

6 |

15% |

25% |

36% |

Cebu (32%), Zest (26%), SEAir (6%) |

| Manila-Dumaguete* |

12 |

37% |

N/A |

44% |

Cebu (56%) |

| Manila-Zamboanga |

15 |

30% |

35% |

50% |

Cebu (50%) |

| Manila-Butuan |

16 |

21% |

15% |

27% |

Cebu (73%) |

| Manila-Cotabato |

24 |

28% |

36% |

50% |

Cebu (50%) |

| Manila-Dipolog* |

25 |

45% |

N/A |

51% |

Cebu (49%) |

The routes PAL has dropped are smaller secondary

routes or trunk routes which are leisure-focused and therefore have

limited demand for premium or business passengers. For example while

Manila-Puerto Princesa is the sixth largest domestic route in the

Philippines, Puerto Princesa is predominately a leisure destination as

it is the main airport serving the resort island of Palawan. The PAL

Group determined that lower-cost AirPhil Express/PAL Express was a

better fit for these routes than PAL as it aims to have just one brand

on almost all domestic routes.

AirPhil has significantly

increased capacity on the routes that have been dropped by PAL and has

launched services to Dumaguete and Dipolog to fill the void left by PAL.

Damaguete is also a leisure destination near popular beaches and dive

sites.

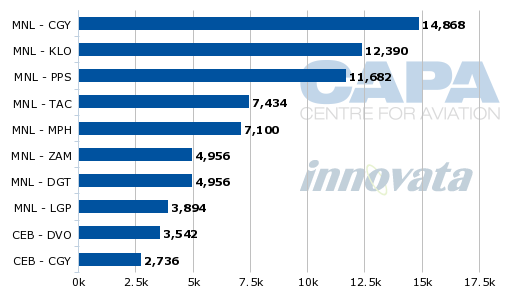

Second phase could see PAL hand over more routes to AirPhil Express

There

are only a handful of domestic routes now remaining that are now served

by both the PAL and AirPhil Express/PAL Express brands. These could be

handed to one brand – in most cases AirPhil Express/PAL Express – as

part of a second phase. On 28-Oct-2012 AirPhil increased capacity on

three of these routes – Manila to Kalibo, Tacloban and Legaspi – while

PAL reduced capacity although for now maintains a small presence.

Mainline

PAL now accounts just 18% of total capacity in the Philippine domestic

market, compared to almost 20% one week ago. The PAL Group now accounts

for just under 39% of domestic capacity, compared to 41% prior to the

implementation of the network changes.

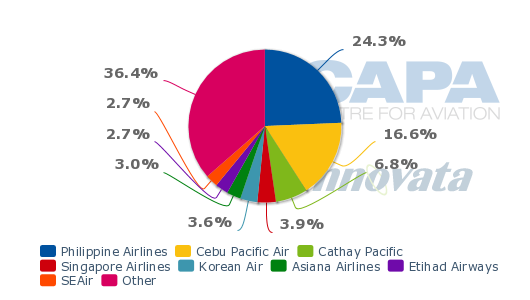

Four other LCCs operate

domestic services in the Philippines and account for the remaining 59%

of the market, led by Cebu Pacific with a 46% share. With the

implementation of the northern hemisphere winter schedule, Cebu

Pacific’s domestic capacity has increased by 4% according to Innovata

data, resulting in a 2ppt rise in its capacity share.

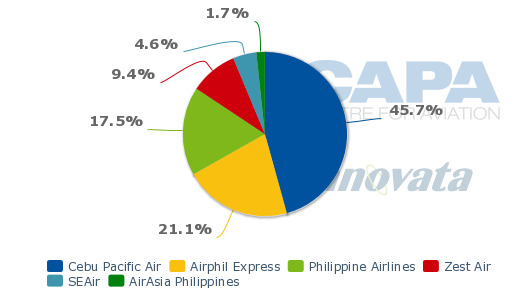

Philippines domestic capacity share (% of seats) by carrier: 29-Oct-2012 to 04-Nov-2012

Source: CAPA – Centre for Aviation & Innovata

The

Philippines has the highest domestic LCC penetration rate in the world,

about 80%, among major domestic markets. The Philippines had about 11

million domestic passengers in 1H2012 with LCCs accounting for 79% or

just nine million passengers.

Cebu Pacific, Zest and SEAir stand to benefit from PAL Group route rationalisation

Cebu

Pacific, Zest Airways and Tiger Airways affiliate SEAir are the main

beneficiaries of the network changes at AirPhil as there is now one less

competitor in the markets AirPhil has dropped. The Philippines’ fifth

LCC, AirAsia Philippines, will only benefit marginally from the network

changes as it only operates from Manila's alternative airport Clark, and

serves only one of the seven affected markets, Davao, with one daily

flight.

AirPhil predominately operates out of Manila

International but earlier this year launched three low frequency

domestic routes from Clark – Cebu, Kalibo and Puerto Princesa – which

are being retained as PAL does not operate at Clark. AirAsia Philipines

now competes against AirPhil in all three of these markets although it

is dropping Clark-Puerto Princesa service on 30-Nov-2012. Cebu Pacific

also predominately operates from Manila and has only one domestic route

from Clark, Cebu, while Zest only serves Manila International.

Consolidation

in the Philippines market is seen as inevitable given the intense

competition and resulting over-capacity, which was exacerbated when

SEAir in 3Q2012 became the fifth LCC to operate domestic trunk routes.

Manila to Cebu, Davao and Bacolod were among the seven domestic routes

launched by SEAir in late Jul-2012 and early Aug-2012 as additional A320

family aircraft were delivered from part-owner Tiger Airways.

It

is unlikely these markets could have continued to support so many

competitors. But AirPhil, as it is backed by PAL, was seen along with

market leader Cebu Pacific as the strongest players. By exiting these

markets, AirPhil is essentially handing market share to its LCC

competitors and significantly improving their outlook. There could still

be consolidation in the Philippines as markets such as Manila-Iloilo

may be unable able to support three LCCs. But it is certainly a better

scenario than having four LCCs competing directly.

Meanwhile, the

network changes at AirPhil have left Cebu Pacific as the only LCC

linking Manila from General Santos and Laoag. It is likely SEAir and/or

Zest will seek to fill the void left by AirPhil in these markets. SEAir

also currently does not serve Taglibaran but may now be tempted to

include this relatively large market in 2013, when it is expected to

pursue further fleet and network expansion.

New PAL Group owners make unexpected determination

The

decision by the PAL Group to have PAL become the only brand in seven

key domestic markets is puzzling and according to PAL Group sources has

raised eyebrows within the group. The change in strategy was made by PAL

Group’s new owners San Miguel, which took a majority stake in both PAL

and AirPhil in Apr-2012, following a recommendation made by LEK

Consulting.

Originally San Miguel was expected to retain the

previous two-brand strategy at PAL Group, which has been in place since

Air Philippines was branded as AirPhil Express in early 2010 and adopted

the LCC model. The PAL Group has since used AirPhil to operate

alongside the PAL brand on trunk routes where there is a mix of business

and leisure traffic, with AirPhil steadily expanding its fleet of A320s

while PAL has gradually been shrinking its domestic operation. AirPhil

has added five A320s over the last year, giving it a fleet of 13 A320s

along with eight Bombardier Dash 8 turboprops.

Having

its two brands serve major trunk routes where there is a mix of

business and leisure traffic made sense as PAL was able to focus on

premium and connecting passengers while AirPhil was able to focus on

point-to-point budget passengers. This two-brand strategy, in place at

PAL since 2010, was similar to the successful strategy at two-brand

pioneer Qantas Group, which has had its LCC brand Jetstar complement

Qantas on several domestic Australia and international routes for

several years. It also follows the strategy at Garuda, which is now

using its fast-expanding Citilink subsidiary alongside the Garuda brand

on main trunk routes. Singapore Airlines and Thai Airways short-haul

low-cost affiliate carriers Tiger Airways and Nok Air, respectively,

also operate alongside the full service brand.

As it has a higher

cost structure than AirPhil, PAL will struggle to compete against LCCs

in the point-to-point market. As the only full service and network

carrier in the Philippines, PAL should retain a presence on major

domestic routes, particularly in those markets that have some demand

from premium passengers. But PAL should not be afraid to have its

AirPhil brand continue to operate in these markets as the LCC subsidiary

caters to a different profile of passengers and is a more effective

competitor against LCCs.

PAL Group sources say AirPhil was making

money on domestic trunk routes including Manila-Cebu and Manila-Davao

while most of its smaller routes have been unprofitable. Sceptics of the

new strategy within the PAL Group expect PAL will struggle to compete

against its LCC competitors on the trunk routes and say there could be a

push to reverse the current strategy and put AirPhil back onto trunk

routes once it becomes clear these routes have become less profitable.

Using AirPhil for secondary and leisure routes is logical strategy

On

the secondary and leisure domestic routes, the switch to AirPhil is

logical as the group looks to reduce its losses in these types of

markets while maintaining service. While these routes will likely remain

in the red, the losses incurred by AirPhil should be less than the

losses incurred by PAL.

On the secondary routes being dropped by

PAL, Cebu Pacific is now the only competitor and giving Cebu Pacific a

monopoly is not an acceptable proposition for the PAL Group. PAL has

struggled to compete against Cebu Pacific on these routes as nearly all

passengers in these markets are budget-conscious. Switching to AirPhil’s

all-economy product and lower cost base should reduce the losses.

The

routes cannot be abandoned altogether as they have some value to the

group’s overall network. PAL will still be able to offer connecting

services onto its international network for passengers from these

smaller markets through a codeshare with AirPhil. The two PAL Group

carriers have already been codesharing but previously the codeshare was

limited to a one-way block space agreement only covering

AirPhil-operated turboprop flights.

PAL to pursue comprehensive codeshare with AirPhil/PAL Express

The

Group is now working on expanding the AirPhil-PAL codeshare to include

AirPhil-operated jet flights, including on routes PAL has dropped. It

will also be extended to include PAL-operated flights, allowing AirPhil

to continue selling tickets on the trunk routes it has dropped.

The

two carriers will also start codesharing on a free-sale rather than

more restricted block space basis. PAL and AirPhil have both just

migrated to a common IT system from Sabre, which allows the two carriers

to easily implement a two-way free-sale codeshare across their domestic

networks (and their international networks if they see a need).

AirPhil

initially took over PAL’s turboprop routes and fleet Bombardier Dash 8s

in 2008. The operation was initially branded PAL Express until the

current AirPhil brand was adopted in 2010. The PAL Group is now waiting

for regulatory approval for AirPhil to readopt the PAL Express brand,

which will cover both the turoboprop and jet operations.

The

AirPhil turboprop operation, which primarily links Manila with regional

airports which cannot accommodate jets, will be maintained as part of

the revised strategy. Cebu Pacific also operates a fleet of ATR 72

turboprops as several high demand markets in the Philippines are not

suitable for jets due to runway length limitations.

For example,

Caticlan, the gateway to the popular resort island of Boracay, can only

accommodate turboprops but high frequency operations from Cebu Pacific

and AirPhil make Manila-Caticlan the ninth largest domestic route in the

Philippines. None of the other routes which Cebu Pacific and AirPhil

now compete on with turboprops are among the top 20 routes in the

Philippines. The two carriers are also the only competitors on several

point-to-point secondary jet routes from Cebu, the second largest city

in the Philippines. More point-to-point flights from Cebu and other

regional centres such as Davao and Iloilo have been the focus of Cebu

Pacific as congestion at Manila makes further expansion at the capital

difficult to pursue.

AirPhil/PAL Express has bright domestic outlook if proper strategy is pursued

Unlike

Cebu Pacific, AirPhil is predominately a domestic operator. Currently

94% of the carrier’s seat capacity is allocated to the domestic market.

The carrier now only operates scheduled services on five international

routes, according to Innovata data. While AirPhil is planning to expand

its international network, with a focus on routes which PAL does not

currently operate, the airline is expected to remain a major player

domestically. Further domestic expansion could occur if PAL realises it

has made a mistake in removing the AirPhil brand from seven important

domestic markets.

Given the drastically different strategic

direction other airline groups have taken in the Asia-Pacific region,

and the intense competition among LCCs in the Philippine domestic

market, it seems inevitable PAL will again adjust its two-brand

strategy. When it does, growth will be further accelerated at

AirPhil/PAL Express as the budget brand will likely resume service on

all trunk routes while remaining the only brand in secondary and

leisure-focused routes.

PAL and its new owners the San Miguel

Group need to recognise nearly all the growth in the Philippines is at

the lower end of the market and pay attention to the successes and

mistakes of its peers. Citilink, for example, was initially used on

secondary routes before Garuda realised it had made a mistake and needed

to use its budget brand alongside the main brand on trunk routes to

compete with LCC Lion Air, which became Indonesia’s largest domestic

carrier in 2009. PAL is in a similar situation with an LCC, Cebu

Pacific, as a larger competitor. While the group is fortunate to have

new owners with deep pockets, PAL cannot afford to continue to make

strategic mistakes. It should reconsider its latest network adjustments

and reverse the changes before it loses more ground to its LCC

competitors.

This is the first in a two-part series on the new

PAL Group Strategy. The second part will look at the group’s two-brand

strategy for the international market.

Top 30 routes on Philippines domestic market (ranked by seats): 29-Oct-2012 to 04-Nov-2012

Source: CAPA – Centre for Aviation & Innovata

Source: CAPA – Centre for Aviation & Innovata

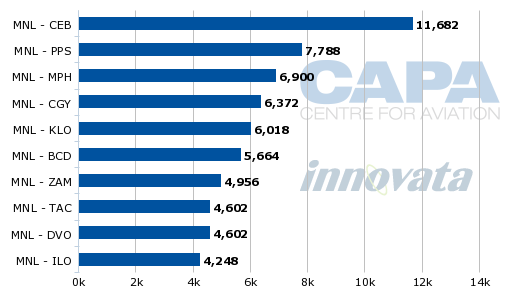

AirPhil Express top 10 domestic routes ranked by capacity (seats): 22-Oct-2012 to 28-Oct-2012

Source: CAPA – Centre for Aviation & Innovata

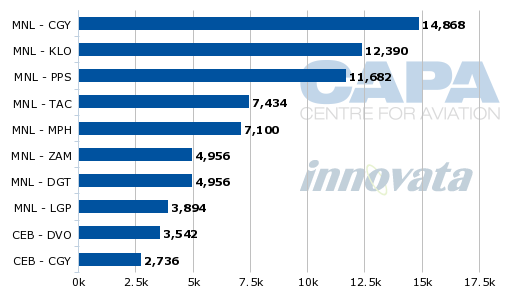

AirPhil Express top 10 domestic routes ranked by capacity (seats): 29-Oct-2012 to 04-Nov-2012

Source: CAPA – Centre for Aviation & Innovata

AirPhil Express top 10 domestic routes ranked by capacity (seats): 29-Oct-2012 to 04-Nov-2012

Source: CAPA – Centre for Aviation & Innovata

Source: CAPA – Centre for Aviation & Innovata

Takes two step up with new long-haul LCC

The Philippine Airlines (PAL) Group is looking at launching a low-cost long-haul operation, potentially in 2013, as part of the Group’s revised two-brand strategy. Allocating some of PAL’s newly acquired A330-300s to its budget brand will help the Group stay competitive with archrival Cebu Pacific, which is planning to launch its own low-cost long-haul operation in mid 2013. A long-haul operation from AirPhil/PAL Express would also allow the Group to re-enter markets in the Middle East, which it has dropped in recent years and is the main target for Cebu Pacific’s new A330 operation.

PAL Group sources say AirPhil Express, which is currently awaiting approval to be re-branded as PAL Express, is expected to receive several of the A330-300s PAL ordered in Aug-2012 for delivery from 2013. Sources say the aircraft will be operated in all-economy configuration and likely be used initially on routes between Manila and destinations in the Middle East.

PAL poised to become third Asian FSC group with low-cost long-haul operation

AirPhil/PAL Express would become the fifth low-cost long-haul operator in the Asia-Pacific region, joining Jetstar, AirAsia X, Scoot and Cebu Pacific. PAL would become the third full service airline group in the region to launch a low-cost long-haul operation, joining Qantas and Singapore Airlines (SIA).

PAL’s entry in the nascent but fast-expanding low-cost long-haul sector could persuade other Asian carriers to launch long-haul low-cost subsidiaries or units. The Thai Airways Group is also considering entering the long-haul low-cost sector.

The A330s are part of a new strategy for AirPhil/PAL Express that is being implemented by the carrier’s new owners, San Miguel, which took control of AirPhil and PAL in Apr-2012. San Miguel has already adjusted the domestic strategy at AirPhil which resulted, in late Oct-2012, in the LCC dropping service on several trunk routes while taking over from PAL several leisure-focused and secondary domestic routes. As a result the AirPhil and PAL brands now only overlap on a handful of domestic routes.

AirPhil/PAL Express to focus on international routes not already served by PAL

The PAL Group’s revised two-brand strategy also envisions minimizing overlap on international routes. AirPhil/PAL Express is expected to only use its anticipated fleet of new A330-300s on routes that PAL doesn’t currently serve.

AirPhil/PAL Express will also focus on new markets to the PAL Group as it expands its narrowbody international operation, which currently only consists of five scheduled routes. For example, PAL Group sources tell CAPA that AirPhil is planning to launch services from Manila to Hanoi and resume services on the Singapore-Cebu route. Cebu Pacific is currently the only Philippine carrier on both routes (Singapore-based Tiger Airways and SilkAir also serve Singapore-Cebu).

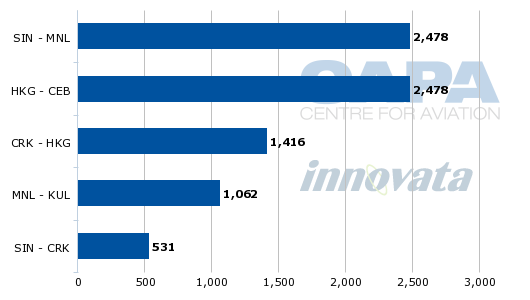

PAL Group sources say there will be exceptions and AirPhil will be allowed to continue operating on PAL international routes that AirPhil holds international traffic rights on, such as Manila-Singapore and Cebu-Hong Kong. The PAL Group would not want to risk giving up traffic rights in these key markets to competitors and these routes are large enough to support both budget and full service brands. Manila-Singapore and Cebu-Hong Kong are now AirPhil’s two largest international routes.

AirPhil’s international routes by capacity (seats): 05-Nov-2012 to 11-Nov-2012

Source: CAPA – Centre for Aviation & Innovata

Note: MNL=Manila, SIN=Singapore, HKG=Hong Kong, CEB=Cebu, CRK=Clark, KUL=Kuala Lumpur

AirPhil, which was known as Air Philippines until 2010, has its own traffic rights as it was previously an independent carrier. The Lucio Tan Group acquired Air Philippines and PAL separately in the 1990s and kept the carriers separate for several years. Air Philippines became the group's budget brand in 2010 after adopting the LCC model and starting to work more closely with PAL. Lucio Tan continues to own large stakes in both carriers but has ceded management control to San Miguel.

The PAL Group’s new focus on avoiding overlapping networks between its two brands contradicts the strategy used at other airline groups in Asia-Pacific, including Qantas and SIA. Jetstar serves a large number of domestic and international routes which are also operated by Qantas. SIA also allowed Scoot to make one of SIA’s biggest routes, Singapore-Sydney, its launch route (albeit at very different scheduled times) while partially-owned Tiger overlaps extensively with SIA.

While PAL should reconsider this strategy and allow its budget brand to operate alongside the main PAL brand on major domestic and international short-haul routes, on long-haul routes the separation will not be as big of a factor in limiting the success of AirPhil/PAL Express. There are several long-haul routes PAL is now unable to viably serve, giving AirPhil/PAL Express plenty of opportunities to build up a long-haul network without overlapping PAL’s relatively limited long-haul network.

PAL looks to use budget brand to re-enter Middle East market

AirPhil/PAL Express in particular could be used to re-establish PAL’s presence in the Middle East. PAL has pulled out of all Middle East markets in recent years due in part to intense competition from Gulf carriers, which have the advantage of offering the Philippine market connecting flights throughout the Middle East as well as to Africa and Europe.

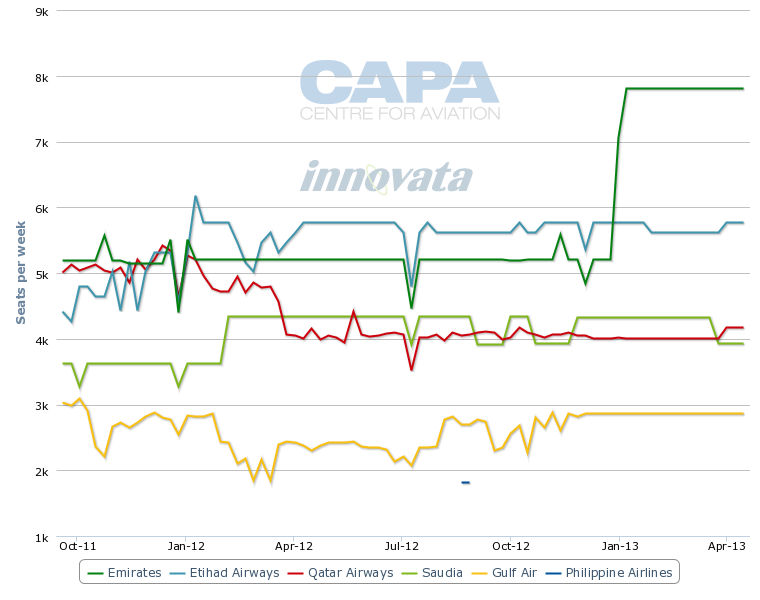

Once Emirates launches it third daily flight to Manila in Jan-2013, Middle Eastern carriers will have almost 50,000 weekly seats to and from Manila. PAL’s long-haul network, in comparison, has less than 14,000 weekly seats, all of which are deployed on routes to North America (see Background Information).

Philippines to Middle East capacity by carrier (one-way seats per week):

19-Sep-2011 to 21-Apr-2013

Source: CAPA – Centre for Aviation & Innovata

PAL now relies on codeshare partnerships with four Gulf carriers – Emirates, Etihad, Gulf Air and Qatar Airways – to cover the Middle East. While PAL will likely extend its existing codeshare with AirPhil to include any routes to the Middle East that AirPhil/PAL Express launches, PAL will be able to continue covering the premium end of the Philippines-Middle East market through existing codeshare agreements with Middle Eastern carriers.

While the local Philippine-Middle East market is large enough by itself to sustain carriers without having to rely on onward connections, this market is extremely price sensitive as it primarily consists of migrant worker traffic and visiting friends and relatives (VFR) traffic. The market is generally considered too low yielding to support full service carriers and could be better served by low-cost carriers. The Gulf carriers serving the Philippines carry some point-to-point traffic but rely more on higher yielding connecting traffic.

When deciding in early 2012 to launch a long-haul operation, Cebu Pacific said a majority of migrant worker traffic between the Philippines and the Middle East were travelling on cheaper one-stop flights rather than the non-stop flights on the Gulf carriers. Cebu Pacific believes it can offer lower prices than these one-stop offerings and take advantage of the fact that most Filipinos prefer to fly Philippine carriers when given the choice.

Cebu is also now considering using its new fleet of A330s to take over some of its A320 flights to north Asia, particularly slot congested airports such as Beijing. Flights to Australia and the US are also a possibility. But the bulk of capacity from Cebu Pacific’s new low-cost long-haul network is expected to be allocated to Middle East routes. There are about 2.3 million Filipinos working in the Middle East, including over one million in Saudi Arabia and over 600,000 in the UAE.

In Oct-2012 Cebu Pacific and PAL both requested from Philippine authorities traffic rights to Saudi Arabia, made possible by a new bilateral between the two countries. The UAE and the Philippines also recently expanded their bilateral, which could lead to flights from both Cebu Pacific and the PAL Group. Currently PAL holds the only rights to both Saudi Arabia and the UAE but dropped Saudi Arabia flights in 2011 and only serves the UAE on a codeshare basis.

AirPhil/PAL Express and Cebu Pacific both opt for A330s in single-class configuration

Cebu Pacific has committed to acquiring at least 12 A330s in single-class configuration with about 400 seats, for delivery starting mid-2013. PAL Group sources say AirPhil also plans to outfit its A330s with all-economy seating. While Jetstar, AirAsia X and Scoot are all operating aircraft in two-class configuration, AirPhil and Cebu Pacific believe the long-haul budget market in the Philippines would struggle to support a two-class product if migrant worker routes are the main target.

PAL in Aug-2012 placed orders for 10 A330-300s for delivery starting in 2013 and has said it is seeking to purchase another of 10 of the type. The Group at the same time also ordered 44 A321s/A321neos which are expected to be used to renew the narrowbody fleet initially at PAL and eventually AirPhil/PAL Express. Both PAL and AirPhil now operate A320s but PAL’s aircraft are older.

PAL already operates eight A330-300s on regional international routes within Asia as well as on some domestic trunk routes. The 20 additional A330s-300s are intended for growth and will be delivered in the new High Gross Weight (HGW) variant. Air Phil/PAL Express could be allocated some of the eight existing A330-300s if the Group decides to have PAL operate the new aircraft.

PAL brand to focus on long-haul expansion in North America and Europe

PAL is also committed to renewing its long-haul fleet, having ordered six 777-300ERs in 2008. More 777-300ER orders or lease commitments are expected as PAL, under San Miguel, seeks to replace its fleet of 747-400s and A340s as well as accelerate expansion of its long-haul network.

San Miguel has said it aims to have PAL re-enter the European market and expand in North America. It is unlikely PAL will resume services to the Middle East as it is more logical to have its budget brand operate these services.

The carrier in Sep-2012 unveiled plans to launch three weekly flights from Manila to Toronto on 30-Nov-2012, following delivery of its fourth Boeing 777-300ER. Manila-Toronto will be its longest route and its first to the eastern portion of North America. The flight will be operated as a non-stop eastbound but will stop in Vancouver on the return westbound sector.

PAL now serves Vancouver in Canada as well as Los Angeles, Las Vegas and San Francisco in the US. But service to Las Vegas, which is now served four times per week as a tag with Vancouver, is being dropped in Jan-2013. PAL will continue to serve Vancouver with four weekly 777-300ER flights, excluding the three weekly flights which will stop in Vancouver on the return leg from Toronto.

PAL is still aiming to expand significantly in the US once the Philippines regains Category 1 status under the FAA’s safety assessment programme. New destinations on the east and west coasts are being evaluated, including New York.

PAL initially ordered the six 777-300ERs primarily for the US market but has been forced to use the aircraft in other markets because under Category 2, Philippine carriers are unable to add new flights or change the gauge of existing flights. PAL has had to continue using its 747-400s and A340s on all its US services.

As Las Vegas was served via Vancouver, PAL also has been forced to operate four of its seven existing weekly frequencies to Vancouver with A340s. Terminating Las Vegas, while not ideal, allows the carrier to transition to an all-777 service to Vancouver, giving premium passengers a more uniform product as only the 777-300ERs feature new generation lie-flat business class seats.

Philippine carriers need authorities to pass audits from US, Europe and Japan

PAL is hopeful the Philippines will finally regain Category 1 status in 2013. If this occurs, PAL will be able to place the two remaining 777-300ERs from its current order, which are to be delivered in 2013, on US routes. It would also likely quickly finalise plans to acquire additional 777-300ERs and potentially redeploy 777-300ERs from Australia and Japanese routes to US routes.

But the carrier has been saying for some time that it is hopeful of a near term upgrade for the Philippines to Category 1. In early 2011 PAL even took the unusual step of hiring a consultant to help Philippine authorities meet Category 1 standards, thinking at the time that an upgrade could be secured within one year.

Cebu Pacific would also benefit from Category 1 status as the carrier recently applied for traffic rights to the US. The carrier intends to initially operate using more expensive wet-leased aircraft until Category 1 can be achieved.

While Cebu Pacific is seeking rights for several US destinations, including in the mainland, Guam and Hawaii are the most logical destinations. Guam can be served from Manila with A320s and Hawaii with A330s but A330-300s do not have the range to serve the US mainland non-stop.

As Cebu Pacific had already stated that the US was not a focus for its new long-haul low-cost operation, it is unclear if the carrier would use its US traffic rights, if awarded, for any market other than Guam. AirPhil is also not likely to use its A330s to fly to the US given the US is now one of PAL’s largest markets and the PAL Group prefers to use AirPhil in markets PAL is not already serving.

PAL’s international expansion plan under San Miguel also hinges on Philippine authorities passing audits from the EU and Japan. Philippine carriers are currently on the EU black list although San Miguel has flagged Paris as a potential destination with the two 777-300ERs to be delivered in 2013.

Philippine carriers are also now prohibited by Japan’s JCAB from adding capacity or launching services on any Japanese route until Philippine authorities can demonstrate they are in compliance with ICAO requirements. South Korea also now prohibits any new Philippine carrier from launching services to South Korea although existing carriers in the Philippines-Korea market are able to add capacity.

AirPhil currently does not serve South Korea or Japan but is interested in launching flights to both countries from secondary destinations in the Philippines such as Cebu and Kalibo, where there is large inbound demand. This could occur once Philippine authorities prove they are in compliance with ICAO requirements.

China and more flights to Southeast Asia also likely as PAL Group expands budget brand

AirPhil/PAL Express is also keen to launch services to China. The carrier would likely launch scheduled flights to secondary destinations in China as PAL now serves the country’s two largest destinations – Shanghai and Beijing – as well as Xiamen.

Unlike South Korea or Japan, AirPhil is not prohibited from launching scheduled flights to China. However, the carrier is waiting for tensions over the Scarborough Shoal, which has led to plummeting demand on China-Philippines flights in recent months, to ease.

Over the last year AirPhil had been aiming to increase its international operation in an attempt to lower its cost base through higher utilisation of its A320 fleet. Most of the carrier’s international flights are operated in the middle of the night, using its fleet of 12 A320s which during the day operate domestic flights. Cebu Pacific has a much higher utilisation rate for its A320 fleet, due to its much larger international network with frequent night flights, giving it a lower cost base and a competitive advantage over AirPhil and other Philippine LCCs.

In Southeast Asia, the PAL Group plans to use AirPhil/PAL Express mainly to compete against LCCs in markets that PAL does not serve. For example, AirPhil earlier this year launched three weekly flights on the Manila-Kuala Lumpur route and the carrier is now planning to increase this service to daily. Manila-Kuala Lumpur is a natural AirPhil route as it is no longer served by PAL but is served by Cebu Pacific and Zest Air. AirAsia also serves Kuala Lumpur from Manila alternative airport Clark.

AirPhil could also be used by the PAL Group to enter international routes where Cebu Pacific is now the only carrier such as Manila-Siem Reap, Manila-Bali and Manila-Kota Kinabalu. These are all primarily leisure routes which PAL would struggle to viably serve. Extending the AirPhil-PAL codeshare to such international routes in Southeast Asia could also provide feed for PAL's expanded operation to North America.

AirPhil currently only has a 2% share of international capacity in the Philippines, compared to about 17% for Cebu Pacific. PAL has an approximately 24% share.

But on international routes between the Philippines and other Southeast Asia countries, Cebu Pacific currently has about a 31% share of capacity, according to Innovata data. LCCs account for about 61% of capacity in this market. The PAL Group only has about a 23% share of this market – including only a 4% share with AirPhil. The PAL Group needs to accelerate expansion at AirPhil to ensure it does not cede more market share to rival Cebu Pacific and other LCCs.

Philippines international capacity share (% of seats) by carrier: 05-Nov-2012 to 11-Nov-2012

Source: CAPA – Centre for Aviation & Innovata

Philippines-Southeast Asia international capacity by carrier: 05-Nov-2012 to 11-Nov-2012

Source: CAPA – Centre for Aviation & Innovata

Philippines can support higher LCC penetration rate in international market

Having a budget carrier for both the short-haul and long-haul international markets is logical given the strategy at PAL’s Asian peers and the fact the Philippines is predominately a budget market. While there will be some growth in the premium market as the Philippines economy expands, most of the growth in the country is at the lower end of the market. To capture this growth, the PAL Group needs a strong budget brand for the domestic, international short-haul and international medium/long-haul markets.

The Philippines already has one of the highest LCC penetration rates in the world, about 60% according to Innovata data. While the domestic LCC penetration is unlikely to grow significantly as it is already above 80%, the approximately 32% international LCC penetration rate will continue to increase as regional markets such as Japan open up and as Philippine LCCs expand into the long-haul market.

The PAL Group needs to make sure it has the budget market fully covered to keep up with larger Cebu Pacific. An A330 operation at AirPhil/PAL Express is logical and would allow the PAL Group to join the long-haul low-cost party at a relatively early stage.

Philippine Airlines international capacity by region: 05-Nov-2012 to 11-Nov-2012

Source: CAPA – Centre for Aviation & Innovata