6 September 2021

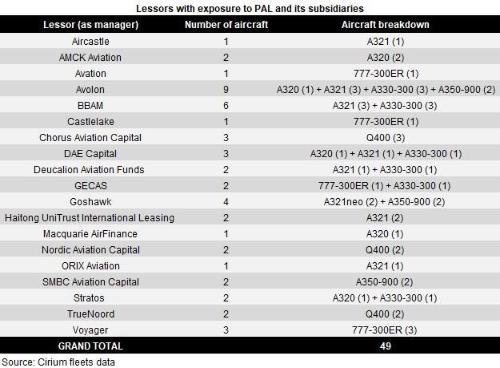

Cuts $2 Billion in Lease CostsFlag carrier Philippine Airlines (PAL) will return 22 aircraft, mostly Airbus and Boeing planes, to lessors as it pursues a financial restructuring program to

survive the covid19 pandemic that has decimated global travel, airline executive said

on Monday.

The PAL executive expects to emerge from Chapter 11 bankruptcy before the end of the year, with a leaner fleet and fewer destinations as a recovery in travel demand isn’t likely in the next few years, Philippine

Airlines President Gilbert Santa Maria said. The first hearing of the said case is slated on Thursday, September 9.

To achieve this aim, Santa Maria said the carrier will need to return more or less 22 aircraft to lessors.

PAL will retain only 70 aircraft after cutting about a quarter of its fleet which now stands at 92 planes from the previous high of 98. The flag carrier has so far returned seven and is set to return 14 more.

Among those to be kept are five Boeing triple seven, (RP-C7772/3/6/8 and 82) from Gecas, Voyager and Avation, three Airbus A350s (RP-C3501/04/08) both from SMBC and Goshawk, and five A330s (RP-C8763/64,81/83/89 from Avolon, CBC, BDO, PNB, and BBam. The rest to be returned are composed of narrow body fleet, mostly the new A321neos and pair of Q400s.

“ A good number of wide-body aircraft are to be returned.” Santa Maria said in a briefing Monday. The wide-bodies is the airline's backbone on long haul international flights. It has since re-commenced flights to North America, Europe and Australia, but it struggles to fit flight as it grapples quarantine restrictions to affected destinations.

The airline said it has already negotiated with Airbus for the postponement of

the delivery of 13 A321neo narrow-body Airbus aircraft set for delivery in 2021 to 2024 and deferred to 2026 to 2030, with an option to cancel six or seven of the previous orders beyond 2026 to 2030, said Nilo Thaddeus Rodriguez, the

company's chief financial officer. The airline also postponed negotiations for six A350-1000 to at least 2030.

The

proposed rehabilitation plan submitted in New York court will cut some $2 billion in borrowings, mostly attributed to aircraft leases of new planes which the airline believes capacity it does not need due to slump in domestic and foreign travel.

Sta. Maria said the retained fleet is more than enough to cover its domestic and international network to sustain its growth projections for the next five years when travel bounces back to 2019 level.

“The remaining fleet will be more than adequate to see our demand through until recovery” which isn’t likely until 2025, he said.

Santa Maria said the airline is still keen on mounting nonstop flights to and from Tel Aviv in Israel.

“[We will] pursue business with Israel when restrictions are lifted,” he said.

The rehabilitation plan includes $505 million in long-term debt equity and debt financing from

the airline's majority shareholder, PAL Holdings Inc., and $150 million of additional debt financing from new investors, the airline said.

"The chance that this will fail is very small," Santa Maria said in a news press conference. The airline also said there will be no further job cuts to be expected after the company reduced its workforce by 30% in March.

Aircraft lessor Avation Plc said it is supporting the process and has agreed on negotiated terms for Philippine Airlines to retain a Boeing 777-300ER plane to its fleet, as the airline intends to retain 5 frames for its long haul requirement, after quarantine restrictions continue to hinder flight growth this year.

“A successful restructuring will ensure that Avation’s aircraft will remain with PAL and that Avation will recommence collecting cash rent on the aircraft for the first time since mid-2020,” the London-listed company said in a statement.