As Philippines reaches 80% penetration on Aviation Travel

October 28, 2011

|

| Airphil Express and Cebu Pacific flights to Tawi-Tawi |

The low-cost carrier penetration rate in the fast-growing domestic Philippine

market is about to reach 80%, a remarkable achievement and a figure

unprecedented in the global aviation industry. An LCC penetration rate

of 85% is even plausible in the foreseeable future as Philippine LCCs,

led by

Cebu Pacific and

AirPhil Express, are rapidly expanding domestically while flag carrier

Philippine Airlines (PAL) continues to reduce domestic capacity.

LCC competition in the Philippine international market is expected to increase significantly, driven primarily by the launch of

AirAsia Philippines,

which was originally planned for this month but has encountered last

second delays. Domestic competition, however, is not likely to increase

as

AirAsia Philippines and the proposed

Tiger Airways-

SEAir

joint venture face uphill battles in their attempt to secure

authorisations for domestic operations. While international routes

linking the Philippines with other Asian countries could see intense

competition from five or more LCCs, the domestic market will likely be

served by two or at most three LCCs in future.

Cebu Pacific and AirPhil

are confident they will emerge as the big domestic winners, with

AirPhil targeting a 30% to 35% share of the domestic market. Cebu

Pacific is positioned to remain the market leader with roughly a 50%

share while full-service carrier PAL is likely to see its share erode to

about 15%.

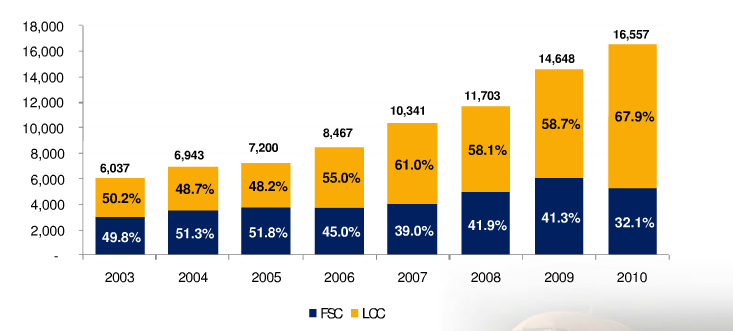

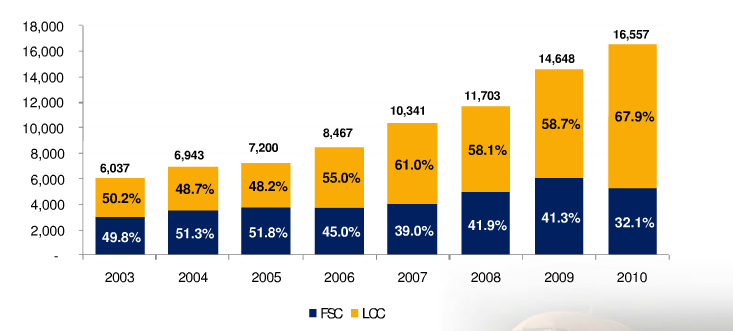

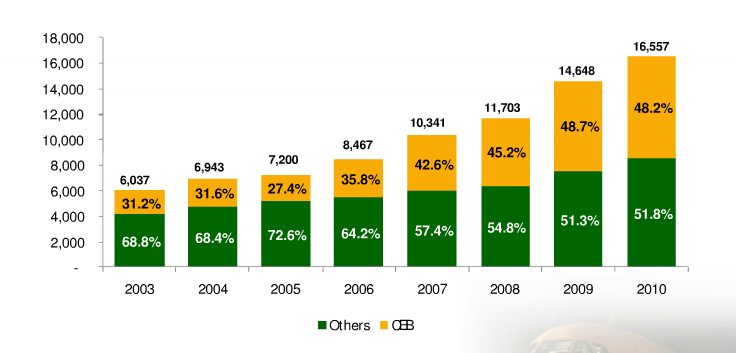

LCC domestic penetration rates reached 68% in 2010 and 75% in 2Q2011

LCC penetration rates in the Philippines have been rising steadily

over the last several years driven by rapid expansion at Cebu Pacific.

LCC penetration rates particularly surged last year, reaching 68%

compared to only 59% in 2009, primarily because of growth at two new

LCCs: AirPhil and

Zest Air. AirPhil, formerly known as

Air Philippines, has pursued rapid domestic expansion since rebranding and adopting the LCC model in Mar-2010. Zest, previously known as Asian

Spirit, initially adopted the LCC model in 2008 and started to pursue more aggressive expansion in 2010.

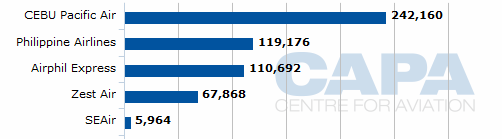

Philippine CAB data shows the three LCCs combined account for 75% of

total passenger traffic in 2Q2011, compared to only 66% in 2Q2010.

Scheduled capacity data for the current week shows LCCs have a 77% share

of the domestic market in the Philippines, with Cebu capturing 44.4%,

AirPhil 20.3% and Zest 12.4%.

Cebu Pacific and AirPhil executives expect LCCs to soon start capturing nearly 80% of the Philippine domestic market.

Cebu Pacific and AirPhil executives expect LCCs to soon start capturing nearly 80% of the Philippine domestic market.

Cebu Pacific and AirPhil are both adding significant domestic capacity

in 4Q2011, as they take delivery of several additional A320s. PAL,

meanwhile, has further reduced its domestic capacity. Over the last two

years PAL has been steadily reducing its A320 fleet, returning aircraft

as leases expire and leasing two A320s to AirPhil.

PAL and AirPhil have common owners and a close partnership which

includes codesharing on domestic routes. CAPA has been informed that PAL

is now only operating 90 daily domestic flights, down from 145 daily

flights previously. The latest capacity reductions were initially

implemented during a ground crew strike at PAL late last month but are

now believed to be permanent. AirPhil handled PAL passengers that were

inconvenienced during the strike and continues to work closely with the

flag carrier as PAL focuses more on the international market, where

there is higher demand for a premium service.

AirPhil to expand A320 fleet to 15 aircraft by end of 2012

AirPhil currently operates eight A320s and eight Dash 8 turboprops.

The carrier is planning to nearly double its A320 fleet over the next

year, with almost all the additional capacity to be deployed

domestically. AirPhil SVP marketing and sales Alfredo Herrera tells CAPA

that the carrier’s ninth A320 will enter service next month followed by

the 10th in December and two more in Jan-2012. Three more deliveries

are planned for later next year, resulting in a fleet of 15 A320s by the

end of 2012.

...“We are still a domestic player first and foremost. International is gravy,”...

Of

the four A320s to be delivered to AirPhil over the next three months,

Mr Herrera says three will be deployed domestically while one aircraft

will be used for international charters. AirPhil is now primarily a

domestic operator with only two daily scheduled international flights: Manila-Singapore and Cebu-Hong Kong. It also has regular charters to several destinations in mainland China.

“We are still a domestic player first and foremost. International is gravy,” Mr Herrera tells CAPA.

By focussing on the domestic market with its first 15 A320s, Mr

Herrera expects AirPhil can be a “strong number two” behind Cebu

Pacific, capturing 30% to 35% of the domestic market. The carrier’s

A320s are being used to build up market share on trunk routes while its

eight Dash 8s are used for some of the several domestic destinations in

the Philippines that have runways that are too short for jets. AirPhil

has five 70-seat Dash 8-400s and three 50-seat Dash 8-300s with the

-300s used exclusively to operate a high frequency service from Manila

to Caticlan, the gateway to popular tourist destination Boracay Island

that is also served by Cebu with ATR 72s.

AirPhil aims to eventually pursue some international expansion, which

would allow it to increase the utilisation of its A320s. But for now

AirPhil plans to only expand its international operations via charters,

partially because traffic rights on prime routes such as Manila-Seoul are not currently available.

...the international routes are key in helping Cebu keep its costs lower than its competitors...

Cebu

Pacific has a much larger international operation, accounting for 21%

of its total capacity. While some of Cebu’s international flying is

currently not as profitable as its domestic operation,

the international routes are key in helping Cebu keep its costs lower than its competitors, including AirPhil, as several of the international flights are operated during overnight hours.

Cebu Pacific to add three A320s in 4Q2011

Cebu Pacific is also adding three A320s in 4Q2011, with most of the

additional capacity being used to increase frequency on domestic routes.

The first of these aircraft was placed into service last week and used

to operate additional flights to three domestic destinations. One more

A320 is slated for delivery by the end of this month, with the last one

expected in December, giving Cebu Pacific a year-end fleet of 29 A320

family aircraft and eight ATR 72s.

Cebu Pacific’s current fleet plan includes four additional A320s in

2012, followed by seven more in 2013. As a result, it expects a fleet of

40 A320 family aircraft and eight ATR-72s by the end of 2013.

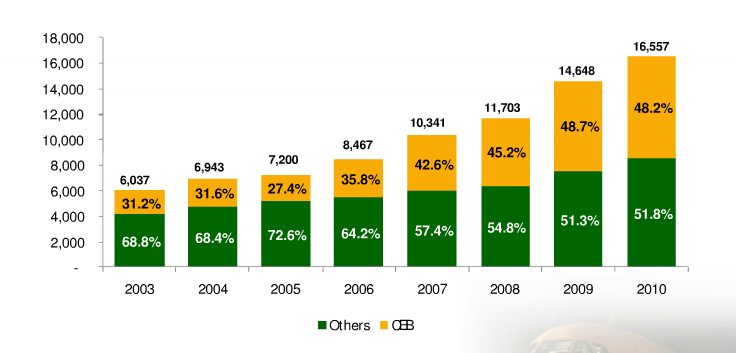

Cebu Pacific has seen its domestic traffic increase by 10% through

the first three quarters of 2010 to 6.7 million passengers. The carrier

also transported 2 million international passengers through the first

nine months of 2011, a 25% increase compared with last year. Last year

Cebu Pacific transported over 8 million domestic passengers, accounting

for 52% of the 16.6 million total passengers in the Philippine domestic

market.

...the main priority is to defend its market leading position domestically...

Cebu

Pacific is primarily focussed on defending its fortress position

domestically, aiming to exploit its first mover advantage in the local

Philippine LCC market and grow at least as fast as its competitors.

Unlike pan-Asian LCC groups such as AirAsia and

Jetstar,

Cebu Pacific does not have an ambition to become a major international

player. The carrier plans to continue growing its international network,

as it helps diversify its revenue stream and keep its A320 utilisation

levels at about 14 hours per day, but

the main priority is to defend its market leading position domestically.

Cebu Pacific sticks with pure LCC model while hybrid model appeals to AirPhil

...“Everyone who gets mixed up will lose money.”...

Cebu

Pacific also plans to stick with a pure LCC model and will not be

tempted by elements of hybrid models, such as codeshares, GDSs and

corporate bookings. Cebu Pacific chief executive advisor Garry Kingshott

told an IATA conference in Singapore

earlier this month that airlines pursuing “blurry models” typically

have lower profit margins than pure LCCs or FSCs.

“In this industry you

are either a low-cost producer or a high differentiator,” Mr Kingshott

said.

“Everyone who gets mixed up will lose money.”

Cebu Pacific uses travel agents locally in the Philippines as credit

card usage remains relatively low in the country but connects with them

via the web. Mr Kingshott is adamant Cebu Pacific will not turn to the

GDSs. “We have far more success today in using Twitter and Facebook as

booking channels,” he said. “We’re in a very complex business.

Everything you touch seems to complex up for whatever reason.”

Cebu Pacific’s insistence on remaining pure to the LCC model could

provide an opening for AirPhil to follow a more hybrid model. AirPhil

already codeshares with PAL and could pursue partnerships with foreign

carriers seeking improved access to domestic destinations in the

Philippines as full-service carrier PAL continues to increase its focus

on the international market. AirPhil already offers some frills, such as

free checked luggage, in an attempt to differentiate its product from

larger Cebu Pacific. In Singapore it also decided to use Terminal 2

instead of following Cebu Pacific into Changi’s budget terminal.

...following a hybrid model comes at a cost...

However, as Mr Kingshott pointed out,

following a hybrid model comes at a cost.

AirPhil’s costs on domestic trunk routes are already higher as its A320

fleet is smaller and utilised less (Cebu Pacific enjoys more economies

of scale with its much larger A320 fleet and utilises its A320s on

average about two more hours than AirPhil, primarily because Cebu

Pacific now does a lot more international flying).

Cebu Pacific also now

has a cost advantage over AirPhil on the turboprop routes because the

ATR-72 has lower per seat costs than the faster but generally less

economical Dash 8. AirPhil also uses a legacy reservation system from

Sabre.

Its codeshare with PAL also adds cost, although this cost is offset as

the AirPhil seats sold by PAL are typically higher-yielding than seats

sold by AirPhil directly.

Future of Zest Air appears more uncertain

There is clearly room in the Philippine domestic market for at least

two LCCs and it would make sense for AirPhil to differentiate itself

from Cebu Pacific by following a slightly different model. Zest Air,

which currently operates seven A320 family aircraft, is probably the

most vulnerable as it is the smallest of the carriers and does not yet

have the economy of scale enjoyed by Cebu Pacific or the partnership

AirPhil has with PAL.

Zest’s most valuable assets are its slots at Manila...

Zest also does not have as much cash at its disposal.

Zest’s most valuable assets are its slots at Manila,

which Cebu Pacific and AirPhil would quickly swoop up if given the

opportunity. The current slot situation at Manila is currently one of

the biggest challenges limiting growth for Cebu Pacific, AirPhil and the

domestic LCC market generally. The carriers are now having to base some

of their additional aircraft at Cebu instead of Manila but believe more

slots could potentially be made available at Manila by improving the

efficiency of operations at the congested airport.

Tiger-SEAir

and AirAsia Philippines are also eyeing the domestic market. But the

incumbents are confident the status quo will be maintained and neither

carrier will secure permission to operate domestic trunk routes.

Tiger and SEAir joint venture remains in limbo

Tiger and SEAir initially filed for domestic trunk routes in 2Q2011

and have since been fighting a show cause order which forced them to

suspend ticket sales and postpone the launch of flights from Manila to

Cebu and Davao. Tiger has said its planned 33% investment in the joint

venture with SEAir is contingent on securing domestic rights. It is

looking increasingly likely that the application will be denied and the

proposed joint venture will fizzle altogether – similar to what recently

happened with Tiger’s planned joint venture in Thailand.

Without the equity tie-up and domestic joint venture, the marketing

tie-up which has been in place between Tiger and SEAir since late last

year on international routes could also be in jeopardy. The marketing

tie-up now includes SEAir operating two Tiger-branded A319s from

Manila's alternative airport, Clark.

Expansion of this operation has been put on hold multiple times. The

marketing tie-up and proposed joint venture excludes SEAir's existing

small turboprop domestic operation, which includes routes from Manila to

regional destinations such as Caticlan and currently accounts for 1% of

total capacity in the Philippines domestic market.

AirAsia Philippines misses launch target

The SEAir Tiger-branded international operation now faces the

prospect of competition on all of its routes from AirAsia Philippines.

The new AirAsia affiliate took delivery of its first A320 in Aug-2011,

unveiling plans to launch services in Oct-2011. AirAsia Philippines was

aiming to start by year-end linking Clark with five international

destinations – Bangkok, Hong Kong, Macau,

Singapore and Seoul – and two domestic destinations – Kalibo and Puerto

Princesa. But ticket sales have not yet begun on any of the planned

initial routes and the AirAsia Group said this week that its new

Philippine affiliate is now aiming to launch services in early 2012 as

it continues to work on securing required regulatory approvals.

...the new carrier has only received a temporary permit for international routes...

AirAsia

Philippines, which plans to operate seven A320s by the end of 2012,

should still be able to launch services on some international routes –

including Bangkok, Singapore and Macau – in 1Q2012.

But sources tell

CAPA some of the planned international routes, particularly South Korea,

are in jeopardy because of a lack of room in existing bilaterals for

another Philippine carrier. AirAsia Philippines may also not receive the

domestic licence it needs to operate the planned Clark-Kalibo and

Clark-Puerto Princesa routes. For now

the new carrier has only received a temporary permit for international routes.

Its first aircraft has been sitting at Clark now for 10 weeks without a

single revenue service and a second aircraft is about to be delivered.

While AirAsia Philippines may have some initial headaches, its

ability to leverage the AirAsia brand and the group’s infrastructure

across Asia should allow it to become established as a major player in

the Philippine international market. Tiger and small local LCC

Spirit of Manila

are the most vulnerable as AirAsia Philippines quickly expands at

Clark. The impact on Cebu Pacific and AirPhil should be limited because

they have the advantage of operating international flights at more

convenient Manila. They are also primarily domestic carriers and are

focussed on profiting from their enviable position in the fast-growing

Philippine domestic market.

Given the slot restrictions at Manila and the challenges Tiger/SEAir

has faced, the Philippine domestic market remains relatively closed. But

with two to three LCCs competing fiercely and an unprecedentedly high

LCC penetration rate, fares will almost certainly remain low. As a

result demand will continue to be stimulated and, as more Filipinos

start to fly more often, the domestic market should continue to chalk up

double-digit annual growth.

As Mr Kingshott

pointed out earlier this month, the domestic LCC penetration rate now

being achieved in the Philippines is without precedent in the global

industry. “It proves if you can take fares to a level where people can afford them, LCCs will succeed,” he said.

While domestic LCC penetration rates of 50% to 60% are common in some other emerging markets - such as Brazil, India, Malaysia and Mexico

- there has never been a domestic market of a significant size with an

LCC penetration rate approaching 80%. In mature markets, such as the US and several European countries, domestic LCC penetration rates are currently about 30%.