15 June 2022

The confirmation of the appointment of Stanley K. Ng, 42, as the new Philippine Airlines President and Chief Operating Officer by its Board of Directors few weeks ago replacing Gilbert Sta. Maria, could be the catalyst for a shift to fleet planning.

Previous to his permanent appointment last month, Mr. Ng disclosed to the public during the 81th founding anniversary of PAL last March 15, that the airline he heads is going to a different direction. What exactly the strategy is, we will try to decipher.

PAL Strategy has changed

|

| PAL Director Lucio Tan III (left) and PAL President & COO Capt. Stanley Ng |

Mr. Ng said PAL will no longer be tied to the old traditional airline models that run on legacy systems, and is aiming to develop new all-cargo markets to “remove dependence on passenger traffic as single-revenue stream.”

Meaning, the airline will now operate the hybrid model, and cater exclusive cargo flights, in the likes of Singapore Airlines (SIA) and Cathay Pacific (CPA).

PAL never had incorporated this model to its business in the past as it concentrated in the transport of passengers. But covid19 changed all that as it diversify to survive. Now, it operates an A320, A330 and B777 exclusively for cargo transport. For a start, that is how their strategy is being run.

Airline business are classified largely by Legacy, Hybrid, and Low Cost Model. PAL has been a legacy carrier all its life. So does SIA and CPA, with exclusive cargo division. So what does PAL try to get away with?

If its domestic operation is any indication, it is doing hybrid alright, following its earlier strategy before the merger with Air Philippines Corporation (PAL Express).

PAL however described this operation as temporary in nature, and will go back to full service carrier (FSC) when conditions improve. Ng said Passenger operations will remain PAL’s core business as the carrier seeks to restore domestic pre-pandemic flights. So what change is forthcoming?

The legacy of PAL

While there is no universally accepted definition of "Legacy carriers", they have been frequently referred in international aviation as airlines which has treaty rights, normally higher cost base, and whose corporate being existed prior to global airline deregulation, like the US Airline Deregulation Act 1978, or the Philippine variant, the airline liberalization of 1995 (EO219).

Prior to airline deregulation, airlines were owned by their respective country that flies its flag, which makes it an extension and representation of the state where they fly to. The prohibitive cost of buying civilian aircraft attributed State ownership, as PAL became a State airline in 1942.

PAL did not become a legacy carrier until 1946 when it was granted rights to fly Australia, Japan, Europe, Hong Kong, and the United States. As a flag carrier of the Philippines, it flies abroad based on a negotiated air services agreement during a time when aviation industry was heavily regulated. This set of regulations defined set of standard services that still existed today, and what type of fleet was needed to service routes.

The advent of airline deregulation across the world prompted the Philippines to sell PAL ownership which was sold to the private sector in 1992, and was eventually controlled by Lucio Tan in 1995.

Airline liberalization in 1995 brought other carriers to life, like Grand Air, Aerolift, Air Philippines, and Cebu Pacific, leading to reduce ticket prices.

Fleet planning has been driven largely by what legacy fleet demands. From the DC-6 to the Boeing 777s to the A350s.

PAL Fleet planning had been tied from its early history up to this date to its legacy status. So what does the new COO try to change?

2012 Fleet Plans

The last fleet planning for the next 15 years was carried in 2012 when its President Jaime J. Bautista, signed orders for 10 Airbus A330-300 aircraft for $2.5 billion, with deliveries planned in 2013-2014, together with narrow body orders of A320s and A321 neos, comprising 54 aircraft in total with a price tag of $US 7 billion, at lists prices.

The narrow bodies were designed to replace all of its international network with better product as they strive to reach the Skytrax five star rating by 2018.

Meanwhile, the wide-bodied aircraft was designed to upgrade product offerings for its regional routes in the Asia Pacific region. Or so the airline would like us to believed it was.

Underlying the press releases, the A330's ordered in 2012 was really meant to diversify regional product offerings to compete better particularly with the pricing strategy of gulf carriers. In reality, it was designed to compete not with the likes of Emirates, or Qatar Airways, but mirroring Cebu Pacific or AirAsia X. A low cost airline. A first glimpse of planned hybrid operations. But this was short lived.

Stanley Ng recent declaration last month about turning PAL a hybrid carrier was not really the airline's first time. It already did perform a hybrid role in 2014, were it not for the timely intervention of San Miguel Corporation, which eventually settled with the addition of business class seats to its otherwise mono-class almost offering.

Displeased with the airlines' direction, Six heavier A330s were added by the San Miguel Group with less passengers to do rotations for its premium markets in Hongkong, Korea, Japan, Australia, and Honolulu, complemented with full in flight entertainment systems (IFE), while the dense A330s serves mostly the middle east market.

For that fleet plan, San

Miguel Group opened up more

destinations in the Middle East flying Kuwait, Doha,

Riyadh, Jeddah, Dammam, Abu Dhabi and Dubai.

The next fleet planning would come in 2018, but studies has been made by the airline as early as 2014, taking the experience of other airlines as a cue.

In comparison, the

2012 Fleet plans started in 2009 when Airbus offered its

product for fleet upgrade and replacements, with super-salesman John

Leahy convincing Lucio Tan to get the new A330s to replace the old

A330s, and the new 350s to replace the A340s, and the whale jet, the A380 to replace the B747s. But PAL ditches Leahy's offer to fly the A380-800s in 2006, and

decided to replace its Boeing 747-400s fleet with Boeing 777-300ERs.

SMC Fleet Planning

San

Miguel Corporation head honcho Ramon Ang (RSA), a pilot, and manager of the Philippines biggest conglomerate, had different idea

when taking over PAL management in 2012 and proposed to update its fleet plans for the future.

While

Ramon Ang agreed that the A350 was the perfect replacement for the

A340s, as it proposes to open New York, Toronto, Chicago, and Miami, and

that the A380 is too big an aircraft for the Philippines, he disagreed

about the choices of the triple seven as the B747 replacement.

His

reason is quite simple. If the plane is still incapable of reaching the

Philippines from Los Angeles at maximum payload on some days of the

year, why bother to add it in its fleet. It was sensible that PAL needed a more than capable aircraft, the Boeing 747-800s to

complement the triple seven.

The B777-X program was indeed offered to him in 2013, as he plans to acquire 10 B779s to replace all B77Ws, for delivery in 2025, with options for 10 more aircraft. But PAL needed an additional plane to service North America that is more than capable to service the route all year round, and that was the B748s.

And

there was more to his sleeves, as Mr. Ang prepares to order also 12 Boeing

787-900s for long haul flights to address long-distance, low-volume routes. Had it materialized, delivery would have started in 2016, after sales pitch by Boeing

representatives, who promises him to get his country back in Category

1. The country did went back to FAA category 1 without Boeing's help.

Ang basically throws the hybrid version of PAL out of the window as he planned to maintain the neos, the six A330s, the twelve B789s, four A359s, six B77w and four B748s as full service fleet. Quite a feat had it bore fruit.

In

his legacy plan for PAL, the middle east bound A330s is to be relegated

to Air Philippines and take over PAL operations there, as its low cost

product offering was inconsistent with it as a full service carrier,

perhaps taking a cue with AirAsia X of Tony Fernandez that also had business class, which was quite successful that time.

According to RSA, the B789s shall fly as far as Miami via Vancouver and San Diego via Honolulu. It would also fly Seattle, Sydney, Melbourne, Auckland, Istanbul, and Tel Aviv.

The B789s routes

also listed London, Paris, Rome, Barcelona, and Frankfurt as destinations in Europe by 2016. Delivery is supposed to be completed in 2020.

The

new set of planned Boeing orders by SMC rattled the senses of the Lucio

Tan group, together with unresolved differences in management styles

prompted the two to go on separate ways in 2014, with the LT group

refunding undisclosed investments to SMC. Jaime Bautista returns to PAL,

and has since tabled the Boeing offers, but ordered four more 77ws instead of the B748s for its transpacific trunk-line.

Air

Philippines managed to fly briefly to Dubai in 2014 before reverting

mainline services to PAL in 2015. It also managed to open Auckland. And eventually flew New York via Vancouver. New York was made non stop in 2018. Plans to

open Chicago, San Diego, Rome, Seattle and Tel Aviv stalled.

What

has not been tabled however was the plan replacements for the A340s,

which acquisition would have been decided in 2014 were it not for the

falling out of SMC and LT Group. Eventually, an order for six was made for its replacement in February of 2016, after Airbus demonstrated the model to PAL executives in 2015. It was meant primarily to fly New York, Toronto, Chicago, and London.

2018 Fleet Plans

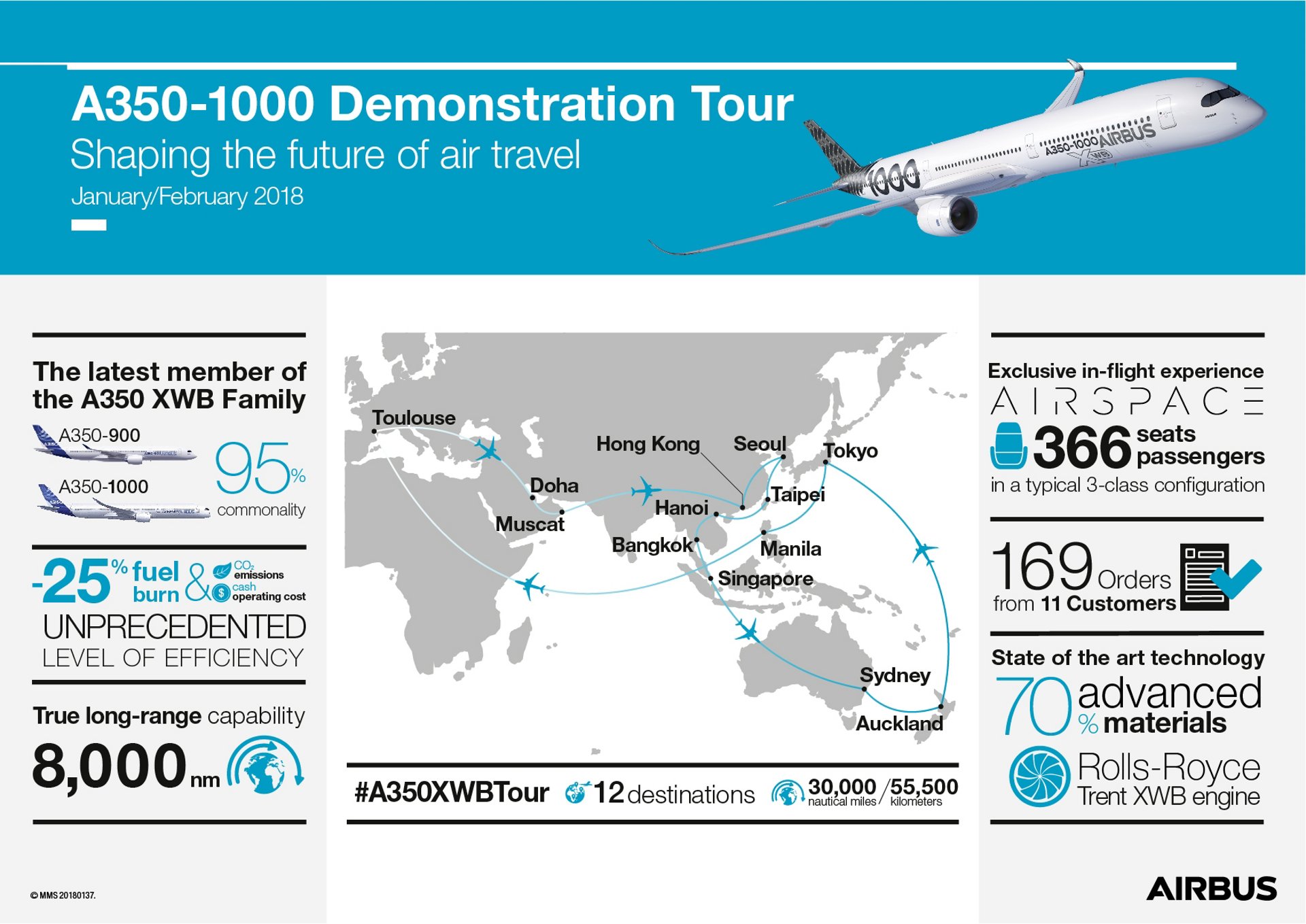

Sometime in the evening of 2018, the Airbus sales team brought the A350-1000 (A35K) to Manila to sell to Philippine Airlines a wide body jet it offered for replacement of its biggest plane in its fleet, the Boeing 777-300ER (B77w) , that needs replacement by 2024. By then the jet was already on certification process. It first flew on Feb 20, 2018 with Qatar Airways from Doha to London.

And it was not only the B77Ws that Airbus offered to be replaced. Airbus brought an offer to match the remaining unfilled order, that of the twelve B787-900s.

Airbus claimed that they had a new plane capable of reaching 7200nm that should fly in 2020 and almost matches the range and payload of the B789s, the 251t A330-900neo (A339) introduced only in 2017. This plane is good enough for PAL to fly HNL, SEA, TLV and AKL at full capacity.

Not that this was the first time they offered it. On the contrary, the A339s was first offered to them in 2016 when orders for the A359s were made, but it was so far an inferior plane to the B789 that its viable option would be like an upgrade only to the A330s the airline currently have.

Meanwhile, on the same year Boeing also made another sales pitch of their new product offering that will fly beginning 2023, in time for the 777s retirement.

Airbus argued that it still was a paper plane. The A350-1000 is the logical replacement for a 777-300ER if a same capacity replacement is sought by the airline. To which PAL agreed.

So what does the A35K has in store that it was so much better than the B779? Could this be the strategic shift in fleet planning? Lets see.

The battle for long haul Supremacy

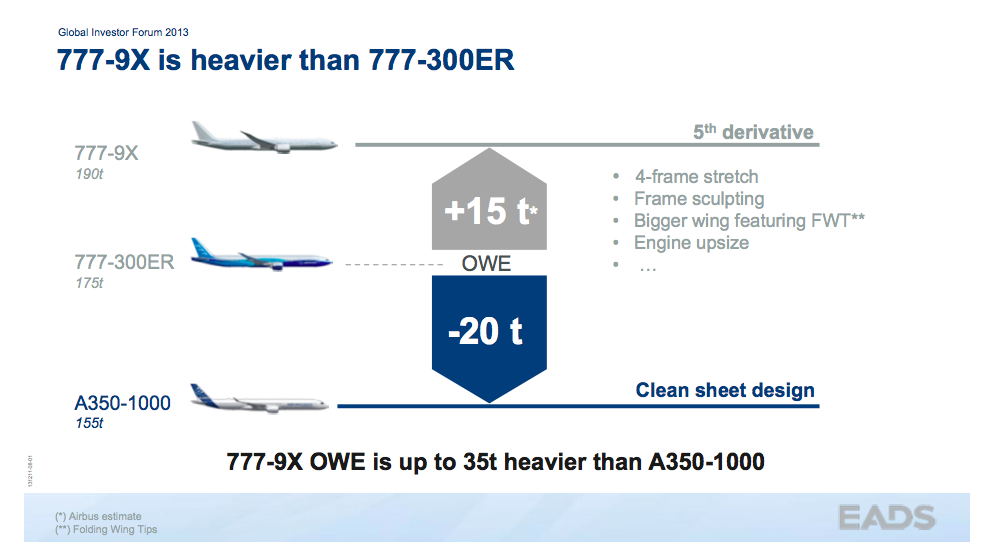

According to A350 XWB Marketing Head Marisa Lucas, the A350-1000 could out fly the B77w and the soon to be operational Boeing 777-900 jet at the current configuration PAL is having right now.

A fully loaded A350-1000 weighs as much as an empty 777-9, she said. The -1000 is 15% more economical than the 777-9, she says. The

Airbus A350-1000 has a list price of $366.5 million, and the 777-9’s

list price is $425.8 million. It is the most expensive plane on Boeing’s

price list.

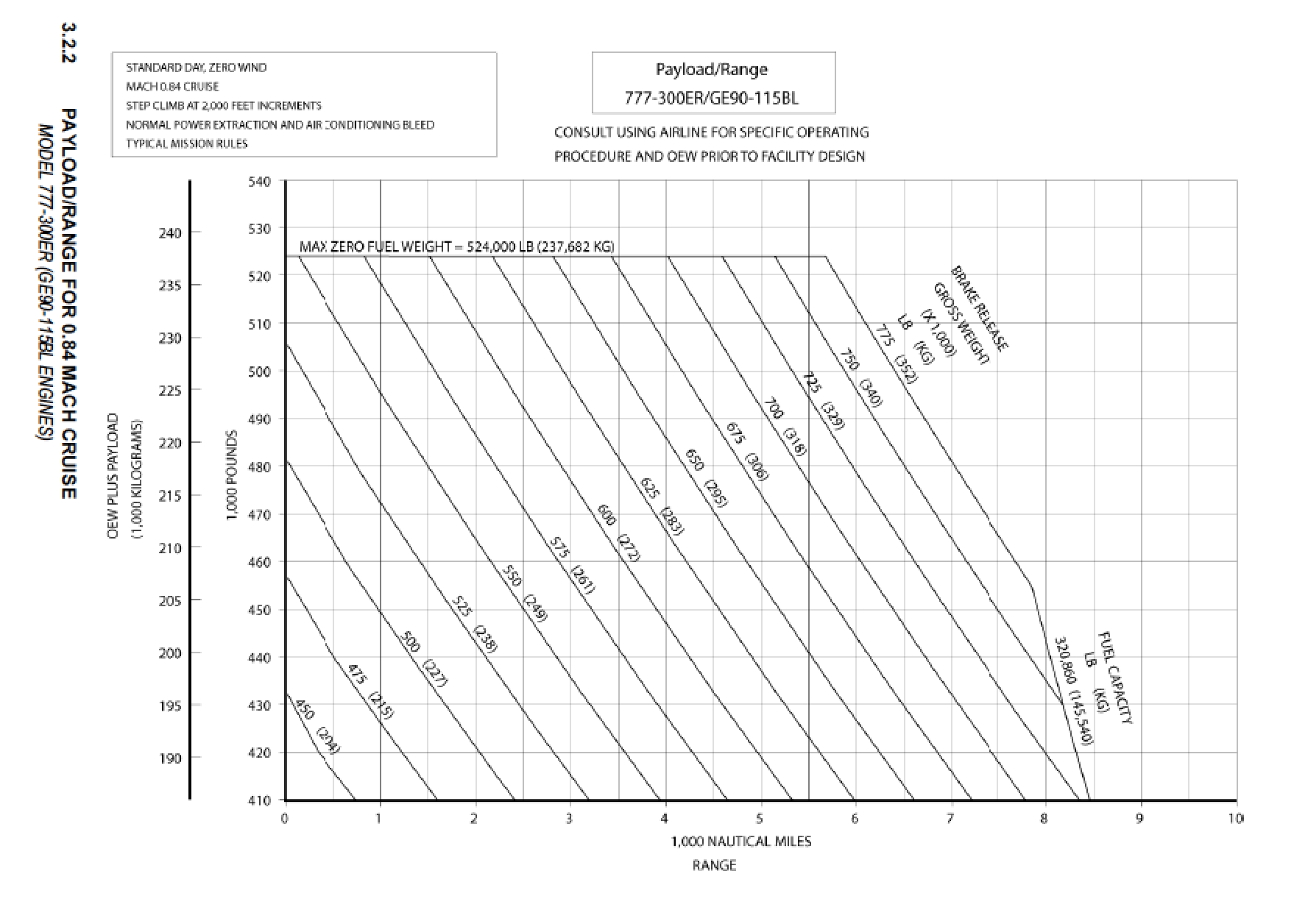

The current PAL 77w is configured by Boeing with 370 passengers with 115,000 pounds payload good enough to reach Los Angeles, its biggest and most profitable market. During winter season however, the airline imposes a payload restriction due to strong headwinds back home, that sometimes caused it to make technical stops in Guam.Airbus argued that while B779 is a bigger plane. carries more passenger and payload, PAL could not use the extra capacity to benefit PAL, particularly to its flight to LAX and back to MNL due to payload restrictions.

According to data provided by Airbus, apparently the B779 could not reach LAX with 400 passengers without substantial payload hit, meaning, it can reach LAX and MNL with 400 passengers but it has to carry less cargo under its belly.Lucas admitted that B779s is the better plane per Cost Per Available Seat Mile (CASM) at less than 6000nm, but not between 6000nm-8000nm.

For the same number of passengers (370) and payload requirements (52-55t) for the same nautical miles (6,000), the A35k could fly 700nm further than the 77w can.

Taking account the range of the 779, For the same number of passengers (370) and payload requirements for the same nautical miles (6,000), it could only generate an additional of 500nm as compared to the 77w, which is barely enough to reach Manila on bad day.

Airbus contend that the discrepancy doesn't end there. For the same range (6,000nm), A35k generates 25% less fuel than 77w and 15% less fuel than B779. That's a huge fuel savings when barrels of oil is hovering above US$100s.

The comparable payloads for MNL-LAX-MNL flights are 52 tons and 55 tons, respectively (calculated using current PAL baggage allowance 50kg, average weight of 90kg per passenger and 20 LD3s with 65kg tare each).

The reality is the A350 will be more efficient for some missions of some airlines while the 777x will be for others. For Los Angeles missions however, A35K is the best plane.

The main reason for selecting the 777-9 will not be efficiency, it will be the revenue generation capability. Which PAL now is trying to capitalized by filling its underbelly.

So the question now is can it generate revenue better with the same payload as the 35K for the same 6000nm sector. the answer is sadly no.

PAL does not also see large capacity as an essential ingredient to maximize the effectiveness of their market model operations as they begin multiple flight operations to city pairs to North America tailor made to PH needs and demands.

While agreement to strategy is one thing, aircraft acquisition and financing is a different thing altogether.

Having said that, price

certainly is a factor in 777 replacements. Financing, leasing and

residual value also matter on every airline executives decision.

While having

percentage discounts off list prices of this long haulers would be a great thing for airlines, list prices doesn’t really mean that

much as Airbus and Boeing also increase list prices at different rates and

discount in different ways, with different services bundled differently.

With all these things taken together, one plane stands out, the Airbus 350-1000s. And it perfectly fits PAL new business strategy. Its smaller sibling, the A339 however fails the new payload requirements for the airline, which makes the B789 still an interesting proposition for long haul.

Airbus does have tricks on its sleeves to sway the orders for more A359s should the A339 still doesn't get the nod. PAL should be ready, as they are preparing now, with these orders in two years time.