April 13, 2012

Philippine Airlines (PAL) and low-cost sister carrier AirPhil Express

are embarking on a new but still challenging era following the sale of

large minority stakes in the two companies to Filipino conglomerate San

Miguel. While Lucio Tan will continue to control majority stakes in both

airlines, the deal is significant as it provides USD500 million

required for fleet renewal and reinvigoration at PAL and for expansion

at AirPhil,

which will be used to fight off increasing LCC competition. It is also

significant as San Miguel will gain management control of both carriers,

which could lead to some adjustments in the group’s strategy.

Philippine Airlines (PAL) and low-cost sister carrier AirPhil Express

are embarking on a new but still challenging era following the sale of

large minority stakes in the two companies to Filipino conglomerate San

Miguel. While Lucio Tan will continue to control majority stakes in both

airlines, the deal is significant as it provides USD500 million

required for fleet renewal and reinvigoration at PAL and for expansion

at AirPhil,

which will be used to fight off increasing LCC competition. It is also

significant as San Miguel will gain management control of both carriers,

which could lead to some adjustments in the group’s strategy.The deal, which was completed last week, hardly comes as a surprise. On numerous occasions Mr Tan has looked to sell part of his stake in PAL, of which he took control 20 years ago after the flag carrier was privatised. The latest round of negotiations with San Miguel and one other potential buyer have been dragging on since late last year. Industry sources say Mr Tan was initially reluctant to include AirPhil, which has a brighter outlook than PAL given its focus on the faster growing budget end of the market, and cede management control in either carrier.

While San Miguel and PAL parent Trustmark Holdings have announced the

deal will involve Trustmark and AirPhil parent Zuma Holdings issuing

new shares in the two carriers to San Miguel Equity Investments, they

have not confirmed exactly how large a stake will change hands.

Reportedly San Miguel will end up with stakes between 40% and 49% in

both carriers. Zuma now owns all of AirPhil Express while Trustmark owns

nearly all of PAL (Trustmark’s control of PAL is estimated to be 97% to

98% as a small minority share in PAL is publicly traded on the Philippine Stock Exchange). Mr Tan controls both Zuma and Trustmark.

PAL could adopt similar strategy to Garuda

PAL is among the weakest of Asia’s major flag carriers, having seen

its share of the Philippine market steadily erode in recent years, and

was in need of a recapitalisation. With the USD500 million coming from

San Miguel, the carrier will be able to embark on a new business plan

that will likely follow a strategy similar to the one used by

similarly-sized Garuda Indonesia. As part of its Quantum Leap business plan for 2011 to 2015, Garuda is investing in rapid expansion at budget brand Citilink as well as in improving its full-service offering through fleet renewal and premium product enhancements.

Garuda is also now in the process of joining the SkyTeam

alliance, which has required a complete overhaul of the carrier’s IT

systems. Joining a global alliance, upgrading IT systems and adding more

codeshare partners will likely become an important component of the

medium to long-term strategy at PAL as the flag carrier looks to expand

its international network and improve its premium product.

PAL has said it plans to use the funds coming from San Miguel to renew its fleet, particularly its ageing Boeing

747-400s. PAL already has four additional 777-300ERs on order, which

are slated for delivery in 2H2012 and 2013. Some of the USD500 million

will likely be used to complete the acquisition of these aircraft while

new widebody and narrowbody orders, including for the A320neo, are also

possible.

PAL cannot compete directly with the country’s fast-growing LCC sector...

PAL

will also likely invest in improving its product in both cabins,

particularly business, through upgraded in-flight entertainment, new

seats and other enhancements. While the Philippine premium market is

relatively small, PAL cannot compete directly with the country’s fast-growing LCC sector

given its higher unit costs and legacy structure. It needs to

differentiate the main PAL brand from local competitors, which are all

LCCs and only offer economy class.

Like Garuda, PAL is no longer the largest carrier in its home market (in Indonesia, Lion Air now carries the most passengers while in the Philippines, LCC Cebu Pacific

carries more passengers). PAL has seen its share of the domestic market

slip to about 20%, based on current capacity, while its share of the

international market has slipped to about 25%.

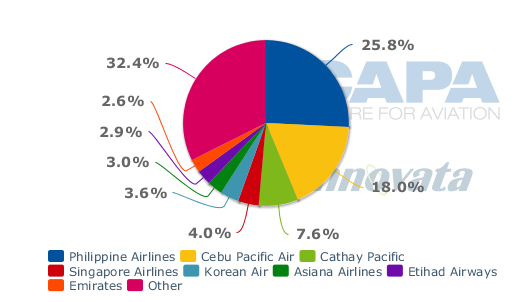

Philippines international capacity share (% of seats) by carrier: 09-Apr-2012 to 16-Apr-2012

Philippines domestic capacity share (% of seats) by carrier: 09-Apr-2012 to 16-Apr-2012

According to Philippine CAB data for 2011, Cebu

carried 45% of the 19 million domestic passengers that were transported

in the Philippines last year, compared to 24% for PAL and 20% for

AirPhil Express. In the international market, PAL flew 25% of the nearly

16 million passengers while Cebu accounted for 16% (see Background

information).

While PAL plans to maintain its presence in domestic and regional

international markets to meet the needs of premium and connecting

passengers, the carrier will likely look to focus primarily on long-haul

markets as it invests in renewing its widebody fleet. Cebu Pacific

plans to launch its own widebody operation next year but this operation

will focus on medium-haul routes to Australia

and the Middle East and only offer economy class. As a result, there is

still an opportunity for PAL to capitalise on its position as the only

Philippine carrier operating long-haul routes and the only local carrier

with a premium product.

Alliance membership and an improved product with a modern fleet could

help PAL find a profitable niche, particularly as the Philippine

economy and tourism sector grow. But there are still numerous challenges

confronting PAL’s long-term viability even though it now has the cash

to survive the current crisis and invest in improving its product.

Gulf carriers limit PAL’s network opportunities in the Middle East and Europe

The Philippines market is now very well served by Gulf carriers, which has already forced PAL to withdraw entirely from the Middle East. PAL also no longer offers services to Europe and is unlikely to enter the market given its inability to compete with the Gulf carriers. KLM, the only European carrier still servicing the Philippines, also recently dropped its non-stop Amsterdam-Manila service for a one-stop Amsterdam-Taipei-Manila offering.

Emirates, Etihad, Qatar Airways and Saudi Arabian combined account for 23% of international ASKs from the Philippines, which is almost as much as the 30% international ASK share held by PAL. In terms of seats, Emirates, Etihad, Qatar and Saudi Arabian have a relatively strong 10% share of the market (all four carriers are among the largest 10 foreign carriers serving the Philippines; Kuwait Airways also serves Manila but with a much smaller operation).

Gulf carriers have a dominant position in the local Philippines-Middle East market and a strong position in the one-stop Philippines-Europe market. Both these markets are big as there are about 2.5 million expatriate Filipinos working in the Middle East and another 1 million in Europe. There is also growing demand from leisure passengers from the Middle East and Europe as the Philippines has started to emerge as a major tourist destination.

Philippines international capacity share (% of ASKs) by carrier: 09-Apr-2012 to 15-Apr-2012

PAL’s outlook clouded by current inability to expand in the US market

The strength of PAL’s long-haul network is now North America, where the carrier makes most, if not all, of its profits. But FAA Category 2 restrictions currently prevent PAL from adding flights to the US or even deploying its two 777-300ERs on existing US flights. There has been some indication that the Philippines will regain its Category 1 status later this year and PAL has tried to expedite this effort by paying for a consultant firm which is helping Philippine authorities meet Category 1 requirements.But Category 1 is far from guaranteed and this uncertainty clearly reduces the value of PAL. In fact, in some respects it is surprising San Miguel has agreed to invest in the carrier while Category 2 restrictions are in place.

Without Category 1, PAL will struggle to find homes for its four additional 777-300ERs on order. Without Category 1, the carrier cannot proceed with its long-delayed plans to add capacity to its three existing US mainland destinations – Los Angeles, San Francisco and Las Vegas (it also serves Honolulu and Guam) – and add new US gateways such as San Diego. Under Category 2, PAL also cannot codeshare with a US carrier, which could dilute its attractiveness to alliances.

In Australia, which also has a relatively large population of Filipinos, PAL faces the prospect of competing with Cebu when it launches its A330 operation in mid-2012. There is also a possibility of long-haul low-cost services from Jetstar.

PAL faces prospect of increased LCC competition on North Asian routes

PAL will also see LCCs eat into its relatively strong position in North Asia as key North Asian markets liberalise. Cebu already has a larger share of capacity than PAL on international routes within Southeast Asia, where it has had fairly unfettered access. But the more restricted North Asia market is a vastly different story. PAL currently accounts for 29% of capacity between the Philippines and North Asia while Cebu has an 18% share, according to Innovata data.Given the Philippines central geographic position, all major cities in North Asia and Southeast Asia are within the range of narrowbody aircraft. Cebu Pacific has been gradually expanding in North Asia as opportunities arise and is expected to significantly improve its 18% market share as the region continues to liberalise.

...competition is already intense in the Philippines-Korea market with five LCCs and four full service carriers...

Cebu

Pacific particularly sees opportunities in the mainland Chinese and

Japanese markets. Some growth is also expected in Korea, which is the

largest source of tourists for the Philippines. But competition is already intense in the Philippines-Korea market with five LCCs and four full service carriers. Cebu Pacific is already the leading LCC between the Philippines and Korea, with an 18% share of total capacity. PAL (22%), Korean Air (25%) and Asiana (21%) are all larger, suggesting there could be opportunity for further LCC growth at the expense of PAL.To Japan, Cebu Pacific now only operates one route (Manila-Osaka) and accounts for less than 3% of total capacity compared to 46% for PAL. Expansion by Philippine carriers in Japan is currently prohibited by Japan’s JCAB. But Cebu Pacific executives told analysts last month during its 4Q2011 earnings call that there are discussions between Japanese and Philippine regulators about removing this restriction, which is somewhat linked to Category 2 in the US. Cebu Pacific is now confident the Japanese restriction will be lifted, at least for carriers that already serve Japan, regardless of the outcome with Category 2 in the US.

Cebu Pacific chief executive advisor Garry Kingshott says the carrier has been very successful in Osaka and capacity expansion opportunities in Japanese markets other than Tokyo could easily support full-time allocation of two to three additional A320s. He sees sufficient demand for more capacity to Osaka as well new services to Fukuoka and Nagoya. Securing rights to Tokyo could be more challenging but Mr Kingshott sees the launch of two new Narita-based LCCs later this year, Jetstar Japan and AirAsia Japan, potentially opening up the Tokyo-Manila market to Cebu Pacific as Philippine authorities would request reciprocity in the event that a Japanese LCC asks to serve the route. Cebu Pacific is confident it can compete well with PAL and Japanese LCCs on the Tokyo route given its significantly lower cost structure.

This gives PAL a huge advantage that will not likely be maintained...

Cebu Pacific is now limited to three weekly flights on Manila-Osaka while Jetstar Asia late last month launched service on the route with four weekly flights that originate in Singapore. Jetstar also has just launched four weekly flights between Manila and Tokyo Narita (which originate in Darwin), illustrating the huge untapped potential for LCCs in the Philippines-Japan market. PAL serves four Japanese destinations – Fukuoka, Osaka, Nagoya and Narita – but does not currently face any competition on two and has very limited LCC competition on the other two. This gives PAL a huge advantage that will not likely be maintained.

Cebu Pacific is also bullish on the China market and believes LCCs are well positioned to capture most of the growth between mainland China and the Philippines. The carrier last month launched service to Xiamen, its fourth destination in mainland China. Mr Kingshott says there are “a number of markets in China that have come on to our radar screen”. There are generally no restrictions on the carrier launching flights to new secondary destinations in China. But expanding in Beijing, Shanghai and Guangzhou is challenging given the slot constraints at China’s major airports (Cebu currently has one flight to Shanghai, four weekly flights to Beijing and three weekly flights to Guangzhou).

PAL now has a leading 40% share of the Philippines-mainland China market, based on current capacity. In comparison, Cebu Pacific has a 23% share.

Cebu Pacific has a similar 22% share of capacity in the humongous Philippines-Hong Kong market, which is more than double the size of the Philippines-mainland Chinese market. Cathay Pacific has a leading 42% share of this market followed by PAL with a 25% share. (In the smaller Philippines-Macau market, Cebu is currently much larger than PAL.)

Cathay Pacific is a formidable competitor to PAL

Hong Kong-Manila is Cathay’s fourth largest route by capacity

(seats), the largest international route for PAL and the second largest

international route for Cebu Pacific. Cathay’s leading market share

between the Philippines and Hong Kong (it is 45% when including its

regional subsidiary Dragonair)

reflects the group’s big presence in the greater Philippines-North Asia

and Philippines-North America markets. Cathay is PAL’s biggest

competitor on the premium end of these markets and will remain a major

player in the Philippines.

It is by far the largest foreign carrier in

the Philippines, with an 8% share of current international capacity.

As it carries a large chunk of premium passengers travelling between

the Philippines and North Asia or North America, Cathay will likely be

the biggest target for PAL as it looks to improve its premium offering.

Korean Air, Asiana, Japan Airlines, All Nippon Airways, China Airlines, EVA Air and Delta Air Lines

(which serves Manila via Tokyo) also play in the Philippines-North Asia

and Philippines-North America premium markets but they all have a much

smaller presence in Manila than Cathay.

Philippines to North Asia capacity by carrier (seats per week, one way): 19-Sep-2011 to 30-Sep-2012

PAL’s key advantage in the Philippines-North American market is its ability to offer non-stops. PAL is currently the only carrier operating non-stop flights to the mainland US and Canada but currently faces restrictions on its US flights due to Category 2.

PAL is now forced to include fuel stops on some of its westbound

flights from the US due to range/payload issues. This would not be an

issue if it was able to replace 747-400s and A340-300s with 777-300ERs

on its US flights – something it desires to do but cannot due to

Category 2 restrictions.

Non-stops are particularly critical to premium passengers. With

non-stop flights and an upgraded premium product, PAL should be able to

hold its own, especially if it succeeds at joining a global alliance. An

expanded operation to North America would also help feed PAL’s routes

to Southeast Asia, which are struggling due to the intense LCC

competition.

PAL needs to expand in North America and improve its product in the

market with 777-300ERs as its current advantages in North Asia will be

eroded as LCCs start to make inroads in the Japanese and Chinese

markets. PAL primarily uses widebody aircraft on its North Asian routes,

partly because of the high demand on these sectors due to the absence

of LCC competition but also because of the current restrictions on

expanding in the US. North Asia is a huge market for PAL, accounting for

nearly half of its international seats. But on an ASK basis, North

America is already PAL’s biggest market, accounting for two-fifths of

ASKs.

Philippine Airlines capacity by region (seats per week): 09-Apr-2012 to 15-Apr-2012

AirPhil has brighter outlook than PAL

AirPhil generally has a better outlook as most of the growth in the

Philippines is at the lower end as it is a market dominated by leisure,

migrant worker and visiting friends and relatives (VFR) traffic. But the

Philippines LCC sector is also very crowded and is already seen by some

as oversaturated. With financial support from San Miguel, AirPhil is

now in better shape to withstand the war now being waged between

Philippine LCCs.

With insisting that AirPhil was included in the sale of PAL, San

Miguel recognised the value of AirPhil and the need to adopt a

multi-brand strategy. AirPhil will be the brand used to grow

domestically and in regional international markets. Growth at PAL will

be relatively limited with the exception of North America, where

significant capacity will be added if and when Category 2 restrictions

are lifted.

AirPhil has been used as PAL’s budget brand since early 2010, when the Air Philippines

name was dropped and the carrier adopted the LCC model. At the time,

Air Philippines was only operating Dash 8 turboprops on behalf of PAL.

AirPhil continues this regional domestic operation, in which it competes

primarily against Cebu’s ATR

72s to airports that cannot be accessed by jets, but after the

re-branding also started competing on domestic trunk routes using A320s

sourced from PAL.

AirPhil top 10 routes by capacity (seats per week): 09-Apr-2012 to 15-Apr-2012

AirPhil codeshares with PAL on its turboprop routes while on the

trunk routes it generally operates alongside PAL, with AirPhil focusing

on the lower end of the market and PAL focusing on premium and

connecting passengers. AirPhil’s traffic doubled last year to about 4

million passengers. Cebu transported just under 12 million passengers in

2011. It has more than doubled its traffic in only four years, from 5.4

million in 2007.

AirPhil now operates 11 A320s and prior to the ownership change had a

strategy in place for steady expansion of three to four additional

A320s p/a. The new funding from San Miguel will support the acquisition

of these aircraft and could potentially lead to an acceleration of the

expansion at AirPhil.

The carrier currently only operates five scheduled international routes, including daily services on Manila-Singapore and Cebu-Hong Kong plus low frequency services from Kalibo to Beijing, Hangzhou and Shanghai. AirPhil also operates international charters and has one A320 dedicated to running charters between Clark International Airport

outside Manila and China. AirPhil has been expecting to focus more on

international expansion once it has built up a larger domestic base.

AirPhil plans to expand international operation from secondary cities

Scheduled flights to several destinations in China, Korea and Japan

are in the carrier’s medium-term plan. But AirPhil’s strategy envisions

operating these flights primarily from Clark

and other secondary airports in the Philippines. This strategy is

primarily due to congestion and lack of space at Manila. But by not

operating a significant number of international flights at Manila, the

carrier will also avoid competing head to head with PAL.

AirPhil particularly sees an opportunity at Clark, which has its own

large catchment area which encompasses the heavily populated northern

suburbs of Manila. Earlier this year AirPhil began domestic operations

at Clark, where it now operates four domestic routes according to

Innovata data. AirPhil does not currently have any scheduled

international flights at Clark but is planning to launch service on the

highly competitive Clark-Singapore route next month. Clark-Singapore is

already served by Tiger Airways/SEAir and Cebu Pacific and is expected to be served by AirAsia Philippines by the end of this year.

New LCCs such as AirAsia Philippines will also have to focus on Clark

due to the lack of space at Manila. As the country’s first LCC, Cebu

has an advantage in that it already has a large presence at Manila. But

Cebu also has some international flights at Clark and has been building

up its operations in other cities, including new point-to-point domestic

routes which bypass Manila.

AirPhil/Air Philippines has been a sister carrier to PAL since the

late 1990s, when Mr Tan purchased the carrier. But the companies have

always been separate with different boards and management. More

cooperation has been pursued since the 2010 re-branding and once San

Miguel takes over management control of the carrier more ties between

the carriers could be pursued. AirPhil has been following the last two

years a strategy similar to Jetstar but AirPhil is not yet fully

exploiting synergies with PAL as is the case with Jetstar and Qantas.

AirAsia Philippines launch further intensifies competition in the Philippines

AirAsia Philippines launched services last month, becoming the country’s fifth LCC after Cebu Pacific, AirPhil, Zest and SEAir/Tiger.

The new AirAsia affiliate is now operating domestic services from Clark

and plans to launch international services later this year.

Zest currently operates both domestic and international routes.

SEAir, in addition to operating turboprops under a domestic regional

carrier model, now operates two A319s on international routes under an

LCC model and as part of a marketing tie-up with Tiger Airways. The two

carriers have been discussing extending this partnership to include

A320s, an equity stake and domestic trunk routes.

...they aim to close the gap with market leader Cebu Pacific...

AirPhil, Zest and AirAsia Philippines are all planning rapid growth this year as they aim to close the gap with market leader Cebu Pacific,

which also claims to be the country’s only profitable LCC. AirPhil,

Zest and AirAsia Philippines plan to add about seven aircraft this year,

giving the trio a fleet of 35 A320 family aircraft by the end of 2012.

Cebu plans to add four A320s, giving the carrier a fleet of 33

A319s/A320s by year-end. There are also seven foreign LCCs currently

serving the Philippines

Cebu Pacific says it plans to grow capacity by 12% in 2012 and

continue expanding at this pace over the next five years as it grows its

A320 fleet to 52 aircraft by the end of 2017. Cebu executives expect

domestic capacity to grow by 10% to 12% p/a over the next several years

while regional international capacity grows by 15% to 20% p/a. This

excludes its new medium/long-haul division, which will start operations

in 3Q2013. The first of eight A330s are slated for delivery to Cebu

Pacific in Jun-2013.

Cebu Pacific long-haul operation will likely not impact PAL significantly

While Cebu’s decision to add widebodies likely led to an immediate

decrease in the value of PAL just as the flag carrier was looking for a

new owner, the impact of the new Cebu Pacific widebody operation on PAL

may not end up being that significant. Cebu Pacific management is

adamant the carrier will not follow a hybrid model. Instead the carrier

will stick to a pure low-cost model with 400-seat A330-300s in

all-economy configuration. Cebu Pacific management also says they have

no intentions to forge codeshares and are unlikely to add interline

agreements. Currently Cebu Pacific has one limited interline agreement,

with Hawaiian Airlines.

Cebu Pacific management also does not envision Cebu Pacific launching

services to Europe or North America. Most European and North American

routes from Manila (Hawaii and Moscow would be the only logical

exceptions) would require a one-stop service given the range of Cebu’s

A330-300. Cebu Pacific says it is not interested in operating one-stop

flights as they are too complex. Cebu Pacific previously studied using

its A320s to serve Sydney or Melbourne with a stop in Darwin but concluded it is hard to make money on one-stop services under the low-cost model.

Hawaii would be within range but Cebu Pacific management say it is

unlikely the carrier will serve the Hawaii market. This is good news for

PAL and Hawaiian Airlines, both of which operate between Honolulu and

Manila.

Cebu Pacific management is primarily targeting the Middle East, particularly Saudi Arabia with three potential destinations along with the UAE

and Qatar. While all these markets are now served from Manila by Middle

Eastern carriers, Cebu Pacific says there is not sufficient capacity

given the large number of Filipinos living in the Middle East and that

most expatriate workers are opting for less expensive one-stop services.

With its low-cost structure, Cebu Pacific believes it can match or

undercut the fares on these one-stop services while offering a non-stop

product which will appeal to Filipinos. Cebu Pacific management believes

it can achieve a 35% cost advantage compared to other carriers on

routes to the Middle East but says on longer routes this is not

achievable at current fuel prices.

As Cebu Pacific is not interested in

launching routes unless it can achieve such a cost advantage, the

carrier’s new long-haul division plans to stick to medium-haul or

shorter long-haul flights, primarily Middle East and potentially

Australia.

PAL should be able to maintain its role as the only Filipino carrier in the key North America market...

Given

Cebu’s intentions with its new long-haul low-cost division (it does not

plan to apply for a separate operators certificate), PAL should be able to maintain its role as the only Filipino carrier in the key North America market.

In addition to the US, PAL also serves Canada, which has a large

Filipino population and does not suffer from Category 2 restrictions.

PAL it appears will also be able to maintain its position as the only

Philippine carrier offering a premium product and following a network

model. While premium demand in the Philippines is relatively limited,

the country’s economy and high-end inbound tourism are growing. If PAL

can improve its premium product and join a global alliance, it should be

able to compete better with foreign full service carriers serving the

Philippines.

There are huge risks facing PAL, including the possibility of the

Philippines remaining in Category 2. PAL may also have trouble

persuading a global alliance to accept the carrier. Securing a new major

shareholder with deep pockets means PAL now faces a much more certain

future. But many of its challenges remain and PAL has a lot of work hard

work ahead if it wants to leave the bottom tier of Asia’s flag

carriers.

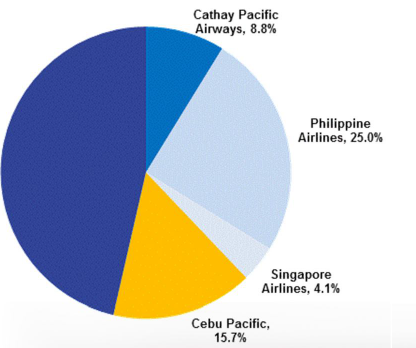

International traffic share (% of passengers) in the Philippines: 2011

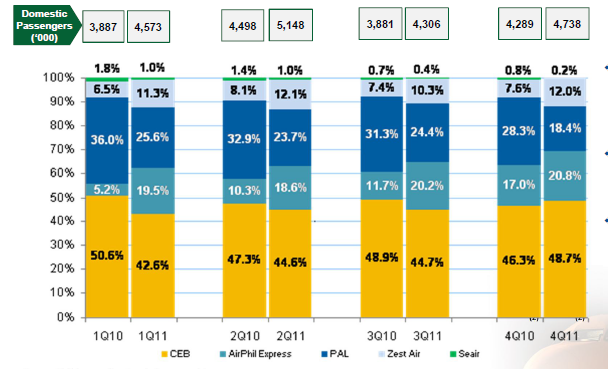

Domestic traffic share (% of passengers carried) in the Philippines by carrier: 2011 vs 2010

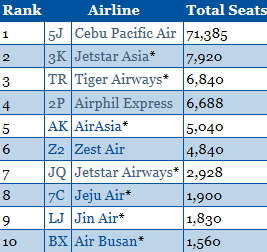

LCC capacity (seats per week) by carrier in the Philippines: 10-Apr-2012 to 17-Apr-2012

No comments:

Post a Comment