March 2, 2009

Geneva - The International Air Transport Association (IATA) announced international scheduled traffic results for January showing a deepening year-on-year demand slump.

International passenger demand fell by 5.6% in January 2009 compared to the same month in 2008. It is also a full percentage point worse than the 4.6% year-on-year drop recorded in December. The January fall in demand is the fifth consecutive month of contraction.

The 5.6% drop in passenger demand outpaced capacity cuts of 2.0% driving the load factor to 72.8% - 2.8% below what was recorded for January 2008.

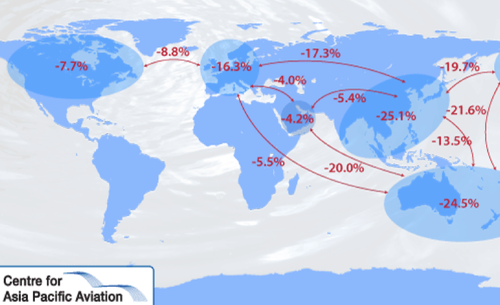

The alarming collapse in cargo markets in December (-22.6%) worsened in January 2009 with a 23.2% year-on-year demand drop. This is the eighth consecutive month of contraction for freight traffic.

“Alarm bells are ringing everywhere. Every region’s carriers are reporting big drops in cargo. And, aside from the Middle East carriers, passenger demand is falling in all regions. The industry is in a global crisis and we have not yet seen the bottom,” said Giovanni Bisignani, IATA’s Director General and CEO.

Passenger

- Asian carriers led the decline in passenger demand with an 8.4% year-on-year drop in January. While this is slightly better than the 9.7% contraction in December, this is positively skewed by Chinese New Year which fell at the end of January 2009 (and which was in February the year before). Capacity in the region contracted 4.3%. With Japan, the region’s largest market for air travel, expected to see its economy contract by an unprecedented 5% in 2009, the prospects for traffic in the region remain dismal.

- North American carriers posted the second largest passenger decline at 6.2% led by a decline in Trans-Pacific travel. In response, carriers withdrew 2.6% of their international capacity, clawing back some of the expansion of 2008.

- European carriers offset a 5.7% decline in demand with a 3.6% decrease in capacity. Demand decreased sharply from the 2.7% fall in December as European economies move into deep recession.

- Latin American carriers saw a modest decline of 1.4%. Even against a 0.5% increase in capacity, the region turned in the highest load factors at 74.9%.

- African carriers saw the demand decline slow from an average 4.0% in 2008 to 2.6% in January.

- The Middle East was the only region with a positive traffic growth of 3.1%. This is far below both the double-digit traffic growth in 2008 and the 10.8% expansion in capacity.

Cargo

- Asia Pacific carriers, representing 43% of the market, led the cargo decline with a 28.1% year-on-year drop. This was followed closely by the other major market players: European carriers (-23.0%) and North American carriers (-19.3%).

- While this may appear to be relatively stabilised compared to the precipitous December drop, it is too soon to call a bottom in the air freight market. Manufacturers are still shedding inventory and cutting production which is expected to lead to further falls in freight volumes.

“The only good news is that fuel prices remain well below last year’s level. But the drop in demand is much more harmful. The industry is shrinking with revenues expected to fall by US$35 billion to US$500 billion, delivering a loss of US$2.5 billion this year,” said Bisignani.

“Airlines remain in intensive care, but while others ask for government bailouts, our demands on Governments are much more modest. First, don’t tax us to death in order to pay for investments in the banking industry. This includes the UK government’s plans to increase its multi-billion pound Air Passenger Duty and the Dutch Government’s misguided departure tax,” said Bisignani. In 2008, even as governments delivered tax breaks to stimulate economic growth, the airline industry took on an additional tax burden of US$6.9 billion.

“Second, give airlines the commercial freedoms that every other business takes for granted. With the world’s capital markets in disarray, archaic ownership restrictions are an unnecessary burden that must be lifted. Today’s crisis highlights the need to change the structure of this hyper-fragmented and fragile industry,” said Bisignani, referring to IATA’s Agenda for Freedom initiative.

Despite the bleak numbers, budget carrier Cebu Pacific said its additional aircraft are coming to its fleet this year that would increase its passenger volume to about 9 million from 6.747 million in 2008.

Despite the bleak numbers, budget carrier Cebu Pacific said its additional aircraft are coming to its fleet this year that would increase its passenger volume to about 9 million from 6.747 million in 2008.

Cebu Pacific, Zest Airways and Philippine Airlines are expanding their fleet this year to service new routes despite global slump.

| Jan 2009 vs. Jan 2008 | RPK Growth | ASK Growth | PLF | FTK Growth | ATK Growth |

| Africa | -2.6% | -0.6% | 71.1 | -19.8% | -2.0% |

| Asia/Pacific | -8.4% | -4.3% | 73.5 | -28.1% | -8.9% |

| Europe | -5.7% | -3.6% | 71.3 | -23.0% | -5.7% |

| Latin America | -1.4% | 0.5% | 74.9 | -17.2% | -0.1% |

| Middle East | 3.1% | 10.8% | 71.9 | -6.1% | 7.3% |

| North America | -6.2% | -2.6% | 74.3 | -19.3% | -3.6% |

| Industry | -5.6% | -2.0% | 72.8 | -23.2% | -4.9% |

| 2008 vs. 2007 | RPK Growth | ASK Growth | PLF | FTK Growth | ATK Growth |

| Africa | -4.0% | -4.2% | 70.2 | -2.5% | -7.4% |

| Asia/Pacific | -1.5% | 1.2% | 73.9 | -6.6% | -2.5% |

| Europe | 1.8% | 3.8% | 76.6 | -2.8% | 2.9% |

| Latin America | 10.2% | 9.2% | 74.0 | -13.5% | 5.7% |

| Middle East | 7.0% | 8.6% | 74.9 | 6.3% | 8.5% |

| North America | 2.9% | 4.3% | 79.8 | -1.9% | 3.4% |

| Industry | 1.6% | 3.5% | 75.9 | -4.0% | 1.5% |

No comments:

Post a Comment